Global shipping delays and ongoing disruption in the shipping industry will continue to affect global imports and exports throughout 2022. Prices will likely continue to rise, reliability remains at record lows, and congestion shows no sign of easing.

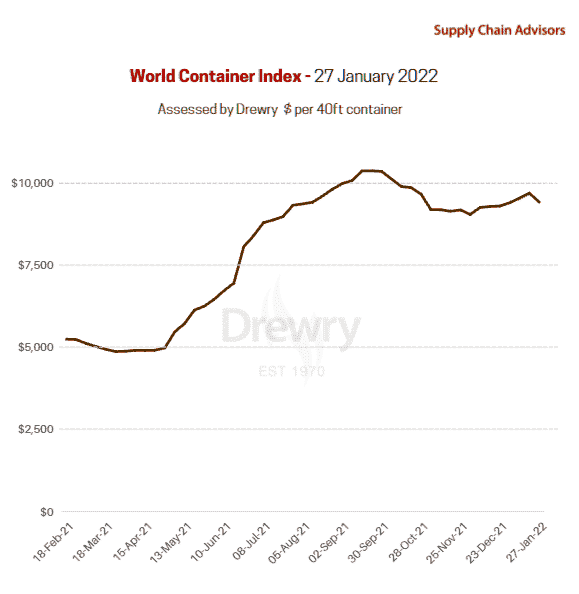

Since our last update, the Shanghai containerised Freight index has increased by 10%, and while the Drewery Index has not shown such a sharp increase in the preceding three months, it has increased by 79% over the past 12 months. This equates to freight prices being up to 10 times higher than pre-pandemic levels.

Unfortunately, these continual price escalations can double or triple the cost of goods Redox imports. Global indications are that the prices will not reduce significantly in the short term and will likely never return to pre-pandemic levels.

Shipping reliability has hit a record low of 32% in December, suggesting only 3 in 10 container vessels arrive at their destination on time. Each delayed vessel arrives 7.33 days late, causing further congestion across all major ports. Vessels were reported waiting off Long Beach/Los Angeles ports for an average of 17.9 days. This not just cause delays to each shipment but reduces capacity and increases shipping costs globally.

One of the most significant impacts on the Global Shipping Industry for 2022 will be China’s Covid policy. If they continue to take a Zero Tolerance approach, how that will affect our imports. Already in 2022, Ningbo Port has been shut down, and there have been many other scares or delays for very small outbreaks. With China home to 7 of the world’s top 10 ports, any closures will have an impact globally, on top of the evident effect of not being able to get goods from that region throughout the closure.

Locally, there have been delays in collecting containers from the ports and additional “Covid Levies” being arbitrarily charged by stevedores and transport companies alike. Sydney and Melbourne Ports have reported delays of up to 9 days due to reduced staffing to discharged ships and load trucks. As a result of this, many companies have added a new Covid Levy. For example, ACFS stevedoring will charge an additional $25 & Qube transport $28.50 per container, adding $53.50 to each import.

While costs continue to increase and reliability continues to dwindle, Redox is doing its utmost to maintain the best pricing and service for our customers. Please continue to stay in contact with your Redox Representative to discuss a range of strategies to reduce risk to your supply chain and to further understand how pricing and reliability will affect your business moving forward.