Molds are filamentous fungi that occur in many feedstuffs including grains and forages. Molds can produce mycotoxins that are formed on crops in the field, during harvest, or during storage, processing, or feeding. The mycotoxins of great concern include aflatoxin (Afla), deoxynivalenol (DON), zearalenone (ZEN), T-2 Toxin (T2), and fumonisin (FUM).

Traditionally, maize was easily contaminated by mycotoxin. However, in a recent survey, 71% wheat samples were contaminated by DON in Australia. Therefore, the routinely use of mycotoxin binders may help ruminant animal to avoid exposure to low levels multiple mycotoxins, considering that these binders could bind mycotoxins strongly enough to prevent mycotoxin absorption across the digestive tract.

Maize has long been known for its susceptibility to mycotoxin contamination. Surprisingly, a recent Australian survey found that 71% of wheat samples were contaminated with deoxynivalenol (DON).

Potential binders include activated carbon, bentonite, zeolite, diatomaceous, earth, cellulose, yeast cell wall polysaccharides, and synthetic polymers such as cholestyramine and polyvinylpyrrolidone.

Activated Carbone: it is a general adsorptive material with a large surface area and excellent adsorptive capacity. It is routinely recommended for various digestive toxicities at 30-50 g per day per cow. previously, it was suggested that Activated Carbone may not be as effective in binding Afla as bentonite or zeolite. However, in a recent in vito trial, it shows an overall better adsorption capacity except for T2 with the lower adsorption capacity.

Bentonite: it is a hydrated sodium calcium aluminum magnesium silicate hydroxide and usually is used as anti-cake agent at 1 to 2% of cattle diets. Based on the recent in vitro trial, it only shows higher adsorption capacity for Afla.

Zeolite: adding 250 to 500 g zeolite per day per cow has been approved to prevent ‘milk fever’. In a recent in vito trial, it also shows a similar adsorption capacity for Afla, T2, and Zen.

Diatomaceous earth: it is usually used as an insecticide on stored cereals and storage rooms. 1% to 2% feed grade diatomaceous earth has also been recommended to add to cattle feed to reduce internal and external worm or parasites. Diatomaceous earth has also shown the potential in vitro to bind Afla.

Yeast cell wall polysaccharides: the outer layer of the cell wall constituted with glucomannan and mannon proteins that determine the superficial properties of the yeast cell wall. The adsorption capacity increases as the proportion of β-D glucans present in the yeast strains increases. However, in a recent in vitro trial, the yeast cell wall product for this trial showed the much lower adsorption capacity compared with the activated carbon.

In general, these mycotoxin binds are helpful to reduce the biavailability of mycotoxin. However, it is difficult to select the appropriate adsorbent for each mycotoxin.

A study compiled by our Redox Animal Nutritionists.

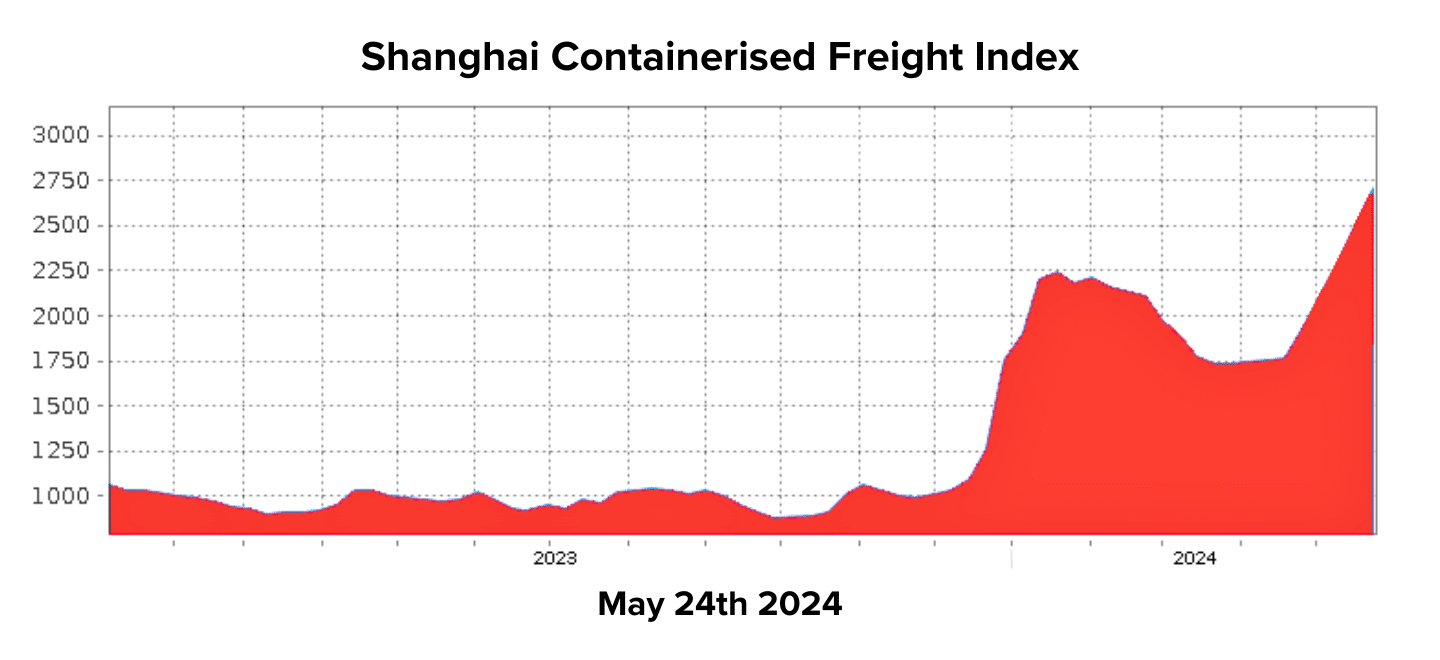

The global shipping industry is grappling with significant disruptions, exacerbated by the Houthi Red Seas attacks and an unprecedented surge in demand. Experts suggest the current situation could prove even more challenging than the COVID-19 pandemic.

One of the major players in the shipping industry, Maersk, has introduced a Peak Season Surcharge, a measure they did not implement during the height of the COVID-19 crisis. The surcharge rates are substantial:

- US$500 per TEU (twenty-foot equivalent unit) from North Asia to Australia,

- US$300 from Southeast Asia to Australia, and

- US$300 from Asia to New Zealand.

The market has seen a jump of over US$1000 per TEU, indicating severe price hikes across the board.

Adding to the strain, Maersk has significantly reduced its allocation from Southeast Asia due to underutilisation earlier this year. While other carriers are temporarily absorbing the excess demand, this presents an ongoing risk to logistics stability.

Transhipment Port Congestion

Transhipment ports, which typically operate smoothly, are now experiencing severe congestion, causing further delays. Cargo that requires transhipment is at high risk of being stuck for extended periods.

Additionally, moving dangerous goods (DG) through certain ports has become increasingly problematic. Recent reports indicate that congestion in Singapore has now surpassed levels seen during the COVID-19 pandemic, compounding the delays.

Equipment Supply Shortages

With more containers spending longer periods at sea, the availability of empty containers at specific ports has sharply decreased. This scarcity of containers is another critical issue with no immediate solution in sight.

Increasing Lead and Shipping Times

Space for shipments from Asia to Australia is currently unavailable until the second week of July, indicating a six-week lead time. The ongoing vessel bunching and transhipment issues suggest that transit times will continue to lengthen in the coming months. While shipments from Southeast Asia to New Zealand are relatively stable for June, the overall outlook remains uncertain.

The Situation in the USA

In the United States, there is growing concern about the return of the US$10,000 container. Shipping rates are increasing by US$1000 per week, with no clear ceiling in sight. The industry is scrambling for solutions:

- Though space is limited, non-dangerous goods rates are available from Xingang and Qingdao to Oakland, Long Beach, Chicago, Newark, and Jacksonville. Suppliers should consider alternative ports and discuss local logistics options with sales representatives.

- Investigating local North American producers and considering road or rail freight across the continent may offer cost-effective alternatives.

For more details on these developments, you can refer to the following articles:

- Maersk Peak Season Surcharge

- Port Congestion Returns to Haunt the Container Markets

- The $10,000 Shipping Container Looms in Latest Trade Strains

The global logistics landscape is facing a critical juncture, and stakeholders must adapt swiftly to navigate these challenges effectively.

ICIS Chemical Business Magazine has unveiled its annual Top 100 Chemical Distributors list for 2024, and Australian-based global chemical distributor Redox has risen to new heights in the rankings.

ICIS Chemical Business Magazine has unveiled its annual Top 100 Chemical Distributors list for 2024, and Australian based global chemical distributor Redox has risen to new highs in the rankings.

Redox confirms it’s place as the largest chemical distributor in Australia, 15th largest in the Asia-Pacific (APAC) region, and the 33rd largest globally (up from 34th rank).

The prestigious list features 323 of the world’s leading chemical distributors, with rankings determined based on revenue generated during the 2023 calendar year.

Remarkably, Redox has made impressive strides in North America, climbing 14 positions as we further expanded our footprint in the US markets with 6 locations.

This achievement underscores the value that Redox delivers to its clients and suppliers, which is made possible by its team’s dedication and hard work.

For the full report, click here.

As part of our commitment to constructive and meaningful support to improving advocacy for industry Redox has joined the Bulk Liquids Industry Association (BLIA).

The association represents businesses that import, export, ship, store, or transport bulk liquids across Australia and provides an important forum for information exchange and discussion of issues relevant to the industry.

The BLIA liaise with relevant port authorities to improve the economics and efficiency of bulk liquids movements into and out of Australian ports and represent members’ interests relating to existing or proposed legislation, industrial agreements or awards.

We look forward to adding our voice and support to debate on important issues of industry debate.

Redox Limited (ASX: RDX) is pleased to announce that Redox has been selected for inclusion in the Standard & Poor’s (“S&P”)/ASX 300 Index by the S&P Dow Jones effective prior to ASX market opening on March 18, 2024.

Raimond Coneliano, CEO and Managing Director, comments, “We are very pleased that Redox has been selected for inclusion in the S&P/ASX 300 Index. This was one of our aspirations during our IPO process last year and we’re satisfied to have achieved this milestone so quickly. In a way, this is recognition of the enduring value that the company has built over nearly sixty years as a leading chemical and ingredients distributor coupled with an exciting growth trajectory as we expand globally. S&P/ASX 300 Index inclusion places Redox amongst the 300 largest securities traded on the ASX. It should help increase Redox’s trading liquidity through incremental demand for our shares from institutional investors and fund managers who track the composition of the Index and benchmark their performance against it.”

The S&P/ASX 300 is designed to provide investors with broader exposure to the Australian equity market. The index measures 300 of Australia’s largest highly liquid securities listed on the ASX by float-adjusted market capitalization. The S&P/ASX 300 index covers the large-cap, mid-cap, and small-cap components of the S&P/ASX Index Series.

This index is designed to provide investors with broad exposure to the Australian equity market while allowing them to benchmark against a wide selection of opportunities based on specific size and liquidity parameters.

The beginning of 2024 has raised concerns about a potential crisis in the International Shipping industry, reminiscent of the challenges faced during the COVID-19 pandemic. Various factors, including instability in the Red Sea, a drought affecting the Panama Canal, and industrial action at DP World, impact both containerised freight’s cost and reliability. In the last week of 2023, shipping rates surged by an unprecedented 40% within a single week, indicating significant disruptions. [1]

Geo-political issues, war & Houthi rebel attacks in the Red Sea have caused an undeniable shock to the global supply chain. Major Containerised shipping lines are now avoiding transiting the Suez Canal and instead diverting around the cape of Good Hope – adding three weeks to their transit times. With 30%[2] of Global container trade passing through the Suez, this has had significant flow on effects to all areas of shipping. Prices have been reported to have surged up to five-fold on European routes and doubled or tripled on other non-European routes. [3]

Red Sea at Aqaba in Jordan – International Shipping impacted by geo-political tensions in the Red Sea. Shipping lines diverting around Cape of Good Hope.

The Panama Canal is facing a severe drought, reducing its operational capacity. As a result, daily traffic has decreased by nearly 40% [5] compared to the previous year, with restrictions allowing only 24 vessels per day instead of the usual 36[4]. This reduction in capacity is impacting shipping lines, either causing them to divert around South America or resort to rail transport across Panama. Customers on the East Coast of America are particularly affected, experiencing increased prices and extended transit times.

Although the Asia to Oceania trade might not be directly affected by issues in the Red Sea and Panama Canal individually, combined, these areas traditionally handle a significant portion of containerised freight movements. Rerouting vessels around Africa alone reduces global containerised shipping capacity by 9% [6], leading to vessels being reallocated from Oceania and other regions. This imbalance results in price hikes and difficulties in accessing empty containers.

While Industrial action at DP World ceased at the beginning of February, the flow of effects will continue to be felt for the coming weeks and months. With a backlog of over 50,000 containers across most Australian ports and vessels out of rotation, delays can continue to be expected until this backlog is cleared. Whether related or not, the deal was reached on the same day as DP World announced prices increases of 52%[7], which will be passed on to the importer.

The hope for stability in the International Shipping Market post the Lunar New Year Holidays is tempered by continued increased transit times due to diversions around the Suez and Panama Canal. This ongoing situation will lead to sustained price and scheduling pressures. Planning ahead, allowing additional lead time, and considering increasing order sizes are advisable. Customers are encouraged to consult with their Redox representatives to devise strategies for minimising risks and addressing any shipping challenges that may arise.

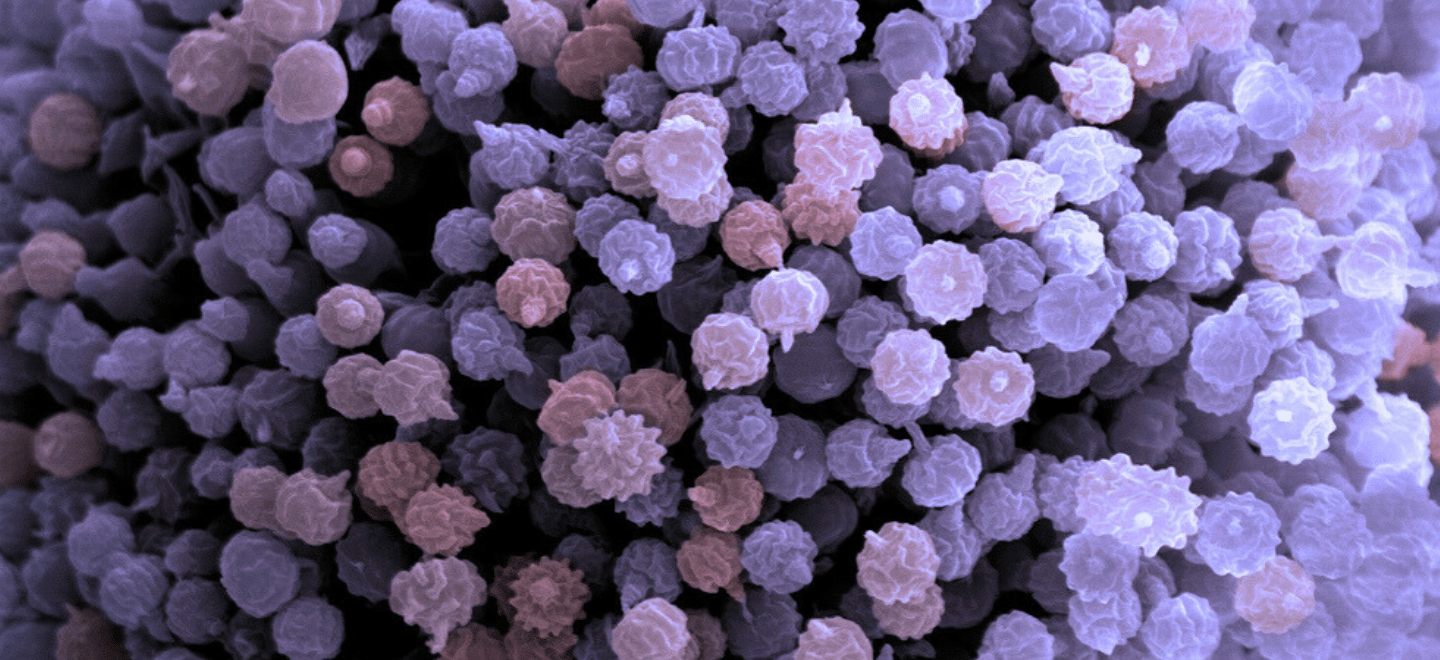

In the often-overlooked realm of soil lies a bustling ecosystem teeming with microorganisms, where a mere teaspoon of soil houses more life than the entire human population on Earth. This intricate world is vital in maintaining soil fertility, influencing nutrient cycling, enhancing plant growth, and even breaking down toxic substances.

Microbial Abundance and Importance:

Delving into the microscopic universe, we find staggering numbers: a kilogram of fertile soil can host 500 billion bacteria, 10 billion actinomycetes, and 1 billion fungi. These microorganisms play a crucial role in soil fertility by cycling nutrients, improving structure, and supporting plant health. They also act as nature’s recyclers, breaking down toxic substances through enzymatic activities.

Factors Influencing Microbial Presence:

Various factors, such as temperature, humidity, oxygen levels, soil pH, nutrient availability, and management practices, influence the presence and activity of microorganisms in the soil. Temperature, in particular, plays a pivotal role in microbial development; at very low temperatures, the enzymatic activity of these organisms is reduced, and protein denaturation may occur at high temperatures.

Humidity and oxygen concentrations also have an important role; in well-aerated soil, there will be greater energy production, a more significant population, and activity of microorganisms. For example, thiobacillus, vital in solubilisation, works more quickly under warm and moist conditions. Low temperatures slow the action of Thiobacillus bacteria.

Microbial Fertilisers and Their Role:

Microbial fertilisers contribute to soil and plant health, comprising bacteria, algae, fungi, and biological compounds. These microbes colonise the rhizosphere upon application, multiplying rapidly and producing trillions of beneficial organisms within a few days. These microbes can act as biological predators, producing antibiotics, enzymes against pathogens, and phytohormone production that benefit plant growth.

Microbial Benefits:

The advantages of soil microorganisms are multifaceted. They help control the spread of diseases through competition, antibiosis, parasitism, and resistance induction. These tiny life forms also play vital roles in nutrient mineralisation, phosphate solubilisation, and controlling soil salinity.

Microorganisms improve a plant’s ability to withstand environmental stresses like water scarcity by employing different mechanisms, such as producing substances that keep the roots hydrated.

Moreover, microorganisms aid in bioremediation, mitigating phytotoxicity and heavy metal contamination by metabolising these substances into inert forms. They enhance plant tolerance to abiotic stresses, such as water stress, through various mechanisms, including producing substances that hydrate roots.

Mycorrhizae – Nature’s Symbiotic Partners:

A significant player in the soil ecosystem is mycorrhizae, a mutualistic symbiosis between soil fungi and plant roots found in over 80% of vascular plants. This partnership enhances nutrient and water transfer, improves soil structure, and boosts plant vigour. Mycorrhizae secrete enzymes that break down nutrients, making them accessible to plants.

Biological Solutions for Sustainable Agriculture:

Highlighting the potential of microbial products, such as Redox Bactivate 3-5 Liquid and Reox Bactivate Biocult, we witness how specific strains of bacteria contribute to better and healthier soil and enhance overall crop quality. These products demonstrate benefits like improved nutrient uptake, soil-bound nutrient solubilisation, and enhanced environmental stress resistance.

How can we help?

In the intricate dance of soil microorganisms and mycorrhizae, we discover a symphony of life that sustains the very foundation of our agricultural ecosystems. By understanding and harnessing the power of these microscopic wonders, we pave the way for sustainable and resilient agriculture, ensuring the health of our soils and the prosperity of future generations.

Contact us today to explore how our microorganism solutions can contribute to your plant’s success. Your plants deserve the best; we’re here to help you achieve just that.

Article compiled by our Redox Agronomists

Global shipping costs are rising due to Houthi rebel attacks on cargo ships near the Red Sea, impacting the Suez Canal and supply chains in Europe and the U.S. Shipments are delayed, and transportation costs are increasing.

In the week ending January 18, the average cost of shipping a 40-foot container worldwide rose by 23% to $3,777, more than doubling from the previous month, according to a report from London-based Drewry Shipping Consultants.

These issues extend beyond trade routes between China, Europe, and the U.S. Shipping rates from China to Los Angeles increased by 38% in the same week, reaching $3,860.

Philip Damas from Drewry Shipping Consultants notes growing unpredictability in international shipping. While big companies with long-term contracts are somewhat protected, many are paying extra fees, like a 20% surcharge, to cover higher expenses.

In Yemen, Houthi rebels attack commercial ships amid the Israel-Hamas conflict. Despite U.S.-led protection efforts, attacks persist, causing damage to cargo ships.

The International Monetary Fund reports a 37% drop in Suez Canal traffic in 2024 compared to the previous year. Major shipping companies, including A.P. Moller-Maersk and Hapag-Lloyd, reroute ships around Africa, adding over a week to travel times.

The Suez Canal is crucial to reducing international shipping disruptions due to its strategic location, providing a vital and time-saving maritime route that connects the Mediterranean Sea to the Red Sea, allowing ships to bypass the lengthy and perilous trip around the southern tip of Africa.

Amidst the avoidance of the Suez and Red Sea by major shipping lines and the preference for rail transport across Panama, retailers assert their ability to handle delays. Nevertheless, Brian Bourke, SEKO Logistics’ global chief commercial officer, highlights that apparel companies, keen on timely spring fashion arrivals, are resorting to airfreight. Maersk and Hapag Lloyd, significant international containerised shipping lines, have suspended ship movements through the Bab-al Mandab Strait, linking the Red Sea to the Gulf of Aden and the Indian Ocean.

Although primarily impacting Asia to North Europe and Mediterranean routes, historical incidents suggest potential serious consequences in other regions if the situation persists.

Paul Zalai, the Director of Freight & Trade Alliance (FTA) and Secretariat of the Australian Peak Shippers Association (APSA), refers to events from March 2021 when the mega-vessel Ever Given ran aground in the Suez Canal “The impact of the waterway closure for six days threw vessel schedules internationally into disarray – this may fade into insignificance compared to the current conditions that are likely to continue for a significant period with other shipping lines likely to follow, understandably not wanting to endanger the lives of seafarers, the safety of vessels and the cargoes they carry.”

“We are likely to know more in coming days – should marine insurers withdraw policies for ships passing through the area or declare the Red Sea a ”war zone”, shipping lines will be commercially left with little option but to abandon this key waterway,” Zalai said.

Zalai says the withdrawal of vessel services from the route will mean their diversion via the Cape of Good Hope. “This will add about ten days to transit times and estimated arrival dates in North Europe and Mediterranean ports – we can again expect that shipping lines will recover these costs through additional surcharges on cargoes.”

Suez Canal problems compound with challenges at the Panama Canal, limiting ship passage due to a drought.

Party City in New Jersey, facing delays of up to a week and extra charges of $300 to $500 per container from Asia to U.S. ports, strives to ensure timely store deliveries despite setbacks.

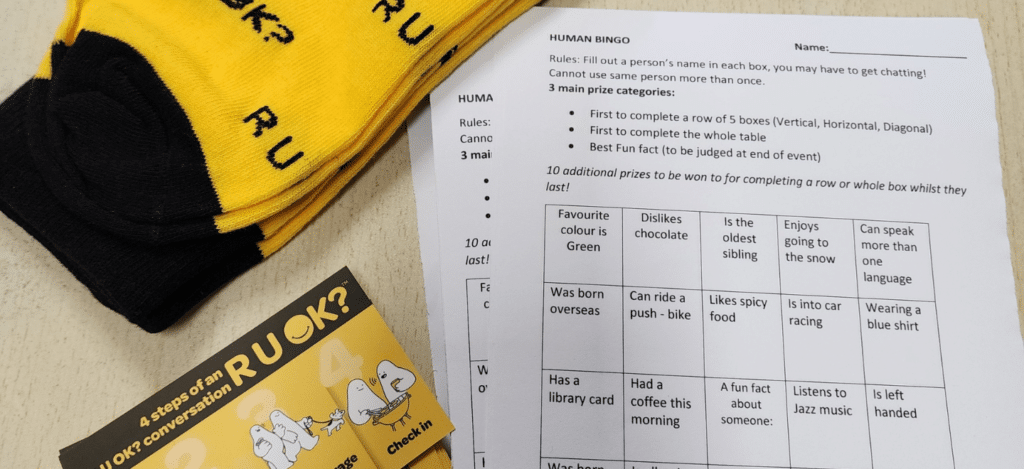

On September 15th, we hosted a special RUOK Day Breakfast BBQ for our valued staff, serving a delectable spread of sausages, eggs, bacon rolls, and more.

R U OK? Day serves as a poignant reminder that any day is an opportunity to ask a simple yet profoundly important question: “Are you OK?” It’s a day dedicated to offering support and compassion to those who may be navigating life’s challenges.

This year, the theme was “R U OK? – I’m here to hear.”

We added a delightful twist to the event by playing an engaging game of HUMAN BINGO. Similar to traditional bingo, the goal was to complete a row, but instead of numbers, we used people descriptors. Laughter and camaraderie filled the air as our team members enthusiastically participated.

Human Bingo Rules

The event was a resounding success, leaving everyone not only with full stomachs but also with a renewed sense of connection and support.

For more information about R U OK? Day and the important work they do, please visit their website.

Redox is committed to nurturing a culture of compassion and understanding within our organisation. We extend our gratitude to our HR department and all the individuals who contributed their efforts on that day. Thank you.

Taurine is a β-amino acid containing a sulfonate instead of a carboxylic group in α-amino acids. It is vital for organ development and aging but not for protein synthesis. Taurine is needed for membrane stabilization, has cytoprotective and cell volume regulation effects, and maintains calcium homeostasis and signalling.

Taurine deficiency impairs growth, fertility, triggers immune deficiency, muscle atrophy, and increased susceptibility of diseases, resulting in a pathological condition known as green liver in strictly marine species due to bile pigments accumulation. Under normal nutritional conditions, fish can produce taurine via methionine-cysteine metabolism pathway.

It is well known that a steady decline of fish meal inclusion levels in aqua cultural feeds has pushed higher inclusion levels of plant protein rich ingredients supplemented crystalline methionine. We assume that the higher level of dietary methionine supplementation might provide a sufficient taurine precursor to support growth rate in fish. However, Gaylord et al (2007) indicated dietary taurine supplementation was indeed beneficial fort rout fed all-plant protein diets, but supplementation of methionine above the requirement could not spare taurine.

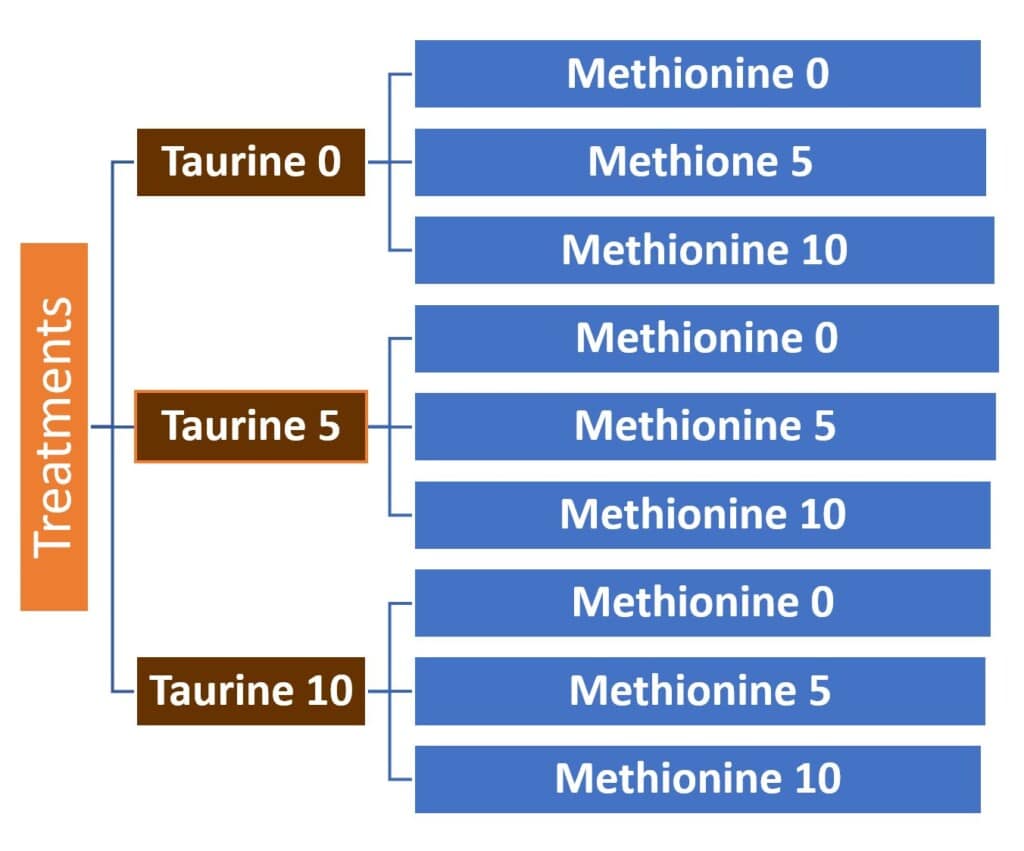

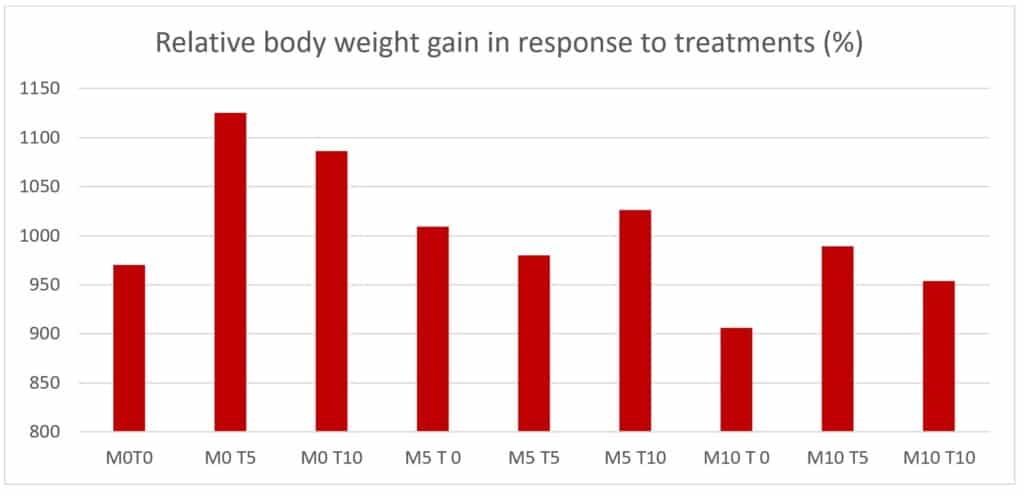

Based on the control diet without supplemental methionine and taurine, taurine and methionine were supplemented at 0, 5, or 10 g/kg diet in a 3 x3 factorial design, respectively (figure 1).

Figure 1. 9 experimental diets in 3×3 factorial design.

The relative body weight gains in 9 dietary treatments were shown in Figure 2. There was no interaction (P > 0.05) between Taurine and methionine supplementation. Adding about extra 6.5 g/kg taurine could optimize Rainbow Trout body weight gain.

Figure 2. Relative body weight gain in response to taurine and methionine supplementation

A study compiled by our Redox Animal Nutritionists.

Our Partnering Manufacturers