ICIS Chemical Business Magazine has unveiled its annual Top 100 Chemical Distributors list for 2024, and Australian-based global chemical distributor Redox has risen to new heights in the rankings.

ICIS Chemical Business Magazine has unveiled its annual Top 100 Chemical Distributors list for 2024, and Australian based global chemical distributor Redox has risen to new highs in the rankings.

Redox confirms it’s place as the largest chemical distributor in Australia, 15th largest in the Asia-Pacific (APAC) region, and the 33rd largest globally (up from 34th rank).

The prestigious list features 323 of the world’s leading chemical distributors, with rankings determined based on revenue generated during the 2023 calendar year.

Remarkably, Redox has made impressive strides in North America, climbing 14 positions as we further expanded our footprint in the US markets with 6 locations.

This achievement underscores the value that Redox delivers to its clients and suppliers, which is made possible by its team’s dedication and hard work.

For the full report, click here.

Please be aware that as of the 7th of October 2021 Redox Pty Ltd has changed name to ‘Redox Ltd’.

Any enquiries about this change can be directed to your contact person at Redox or via our contacts page.

This past month has seen continued container delays, pricing and reliability pressures on the container shipping industry. The issues have become well publicised across most media outlets as information becomes more available.

Containerised freight prices have reported various levels of increases, the Drewry composite World Container index has risen for 17 straight weeks and now sits at $US9421.48 per 40-foot container, a 358% higher than the same week in August 2020.

For our customers, we suggest that you be aware of these increases and understand that this can significantly affect the cost of goods we sell. There is no suggestion that prices will ease in 2022 so please do not wait longer than normal in the hope of freight price reductions. Further to this for longer term supply contracts to ensure we can provide the best service possible discuss options with your sales representative to allow for the ever-changing freight costs.

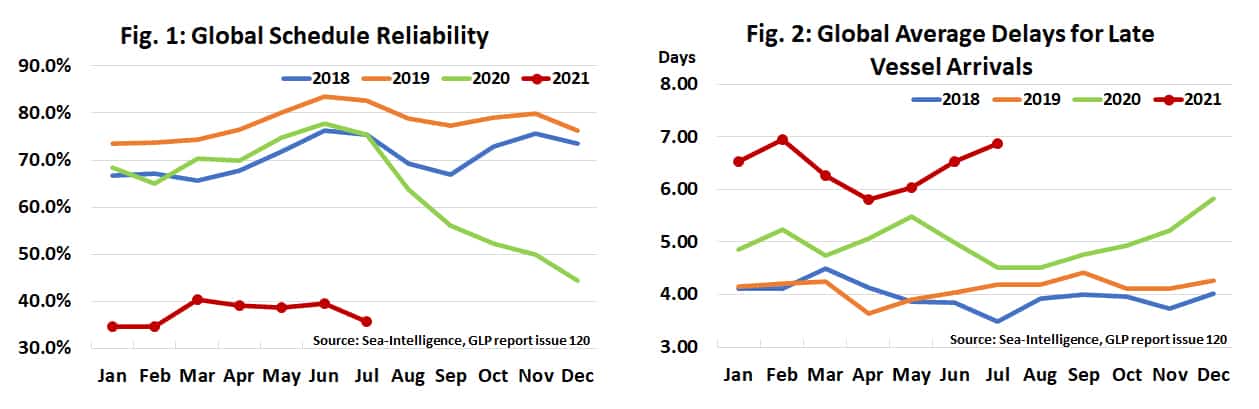

Global schedule reliability has remained reasonably steady at 35-40% for the most part of 2021, the average vessel delay has also been 6-7 days. Noting that, to get containers from Asia to Australia and New Zealand a container may be on 2-3 vessels turning a 6–7-day delay per vessel, into a potential four week plus delay for each container.

To mitigate this risk for our customers Redox owns and operates, 7 sites with the ability to store in excess of 65,000 pallets. On top of this we have a further 50 sites worldwide in which we can store additional stock. As such we suggest either purchasing product early to ensure it is available when needed or discussing a storage solution with your Redox Representative.

We anticipate that these pressures will be ongoing for at least the next 18 Months and we will continue to assist our customers in understanding this information and how to minimise the on-going impact to your business.

Please continue to stay in close contact with your Redox Representative to discuss a range of strategies to reduce risk to your supply chain and to further understand how pricing and reliability will affect your business during the coming 18 months.

Dear customers and partners, we have been informed by both CHEP/ Loscam and other pallet providers that they will not be able to meet the increased demand for pallets.

As a result there may be some delays in delivery, or you may be contacted by your Redox representative and asked if you could consider taking goods on pallets which might not be your first preference.

You may de-hire returnable pallets with Redox and this will help us through the current difficulties, please make sure they are clean and in good shape.

If you are a client who exchanges pallets on delivery it is very important that you have the pallets available to exchange or the delivery may not be unloaded.

Pallet shortages advised by some pallet providers advise that they will not be able to meet the increased demand for pallets.

Since our previous update, shipping conditions have not improved. The widely reported Ever Given Suez Canal issue has caused a further deterioration in the global shipping market. Global prices have continued to increase, reliability reduce & further outbreaks of COVID-19 have disrupted both local and international supply chains.

‘Global supply chains will remain unreliable and container shipping prices and profits high for the rest of the year’ – AP Moller Maersk CEO

Globally, increased consumer demand for retail products, in conjunction with normal shipping demands has meant that there are not enough ships, nor containers in the world to meet demand. Together with reduced reliability & port congestion this has caused global prices to significantly increase. Global shipping price remains 278.4% higher than this time last year[1].

Unfortunately, no one, and no one company are immune to these charges, Kmart, the biggest importer of shipping containers in Australia, was experiencing higher freight costs because it needed to tap the spot container market to meet rising demand. “We get pretty good rates than others but it’s still substantially higher than agreed rates,” [2].

Further to this Auckland Ports are still arbitrarily charging a port congestion fee. Vessels are waiting offshore for 10-11 days before being able to berth[3] or alternatively containers are waiting at Tauranga for 2 – 3 weeks before being able to catch the train to Tauranga. We would actively encourage you to speak to your sales representative about strategies to ease the delay, including unpacking & storing within one of our multiple Tauranga storage & handling facilities.

Container Ships have continued to be at levels not seen in the past 10 years. Only four in ten ships arrive at their port on time, with the average ship being 6.16 days late[4]. A container coming from China to Australia/NZ can easily be on two or three ships, potentially intensifying delays in excess of three weeks.

Across the past 18 months, every region of the world has been affected differently by COVID-19. At Los Angeles Port up 1800 staff or over 10% of staff have been on leave at anyone time as a result of COVID-19.[5] This has caused congestion and delays in excess of 30 days importing and exporting from the USA. In India, there have been similar staffing issues at ports, on top of regional transport prohibitions & suppliers facing government restrictions on operations.[6] These issues are replicated across all countries to varying degrees. However Redox have quality assured suppliers across all corners of the globe to minimise disruptions caused by regional COVID-19 cases and restrictions.

There are suggestions that shipping pricing & reliability will not normalise again until Mid-2023, when ships ordered this year will become operational and be able to meet growing consumer demand mentioned earlier.[7]

To ensure a smooth supply chain for our customers, Redox employs a dedicated team, with hundreds of years of combined experience in international freight. We hold contracts with all major shipping lines and can source stock from multiple different countries. It is important that you keep your account manager aware of future requirements as soon as you become aware.

If you have any concerns at all, please contact your account manager.

Sources:

[1] https://www.drewry.co.uk/supply-chain-advisors/supply-chain-expertise/world-container-index-assessed-by-drewry#:~:text=The%20average%20composite%20index%20of,of%20%241%2C838%20per%2040ft%20container.

[2] https://www.afr.com/companies/retail/grounded-kmart-eyes-10b-in-sales-20210419-p57kiv

[3] https://www.stuff.co.nz/timaru-herald/news/124594274/global-freight-disruptions-impacting-exporters-and-cool-store-operators

[4] https://www.maritime-executive.com/article/first-signs-of-improvement-in-shipping-reliability-and-reduced-delays

[5] https://www.latimes.com/business/story/2021-01-20/covid-surge-hits-la-ports-increasing-need-for-vaccines

[6] https://www.spglobal.com/platts/en/market-insights/latest-news/agriculture/042621-pandemic-tears-through-indias-agriculture-commodity-demand-exports-show-resilience

[7] https://www.seatrade-maritime.com/containers/newbuild-over-investment-could-shorten-container-shippings-bull-run

Since our November update, shipping conditions continue to deteriorate, with the prediction that the traditional easing of restrictions post Chinese New Year will not likely happen.

Pricing has continued to rise with the continued uncertainties surrounding COVID-19, differing rates of economic growth around the world as well as the Christmas & Chinese New Year holidays. The Shanghai Containerized Freight Index, has reached the highest level since 2012 with pricing on all routes ex Asia doubling if not tripling over the past 12 months. In 2021 it is predicted that growth in demand will be in excess of 5% while supply will only increase by 2.3% further exacerbating the price situation. Shipping lines have continued to arbitrarily charge port congestion fees in Sydney & Auckland with no end in sight to these fees.

Loadstar has reported that “December shows just 44.6% of vessels arriving on time, which means that for the fifth consecutive month, global schedule reliability has been the lowest across all months since Sea-Intelligence introduced the benchmark in 2011”. The average container vessel is now arriving at ports over 5.74 days late, a container from China to Australia/NZ can easily be on two or three ships, potentially intensifying delays in excess of three weeks. For our customers we suggest they allow longer lead times and greater flexibility with managing expectations.

The outlook for 2021 suggests that price will continue to rise and shipping reliability will continue to be less than satisfactory. Redox has well established contracts with all major shipping lines, forwarders and staff dedicated to ensuring that goods arrive so that you can access them when needed.

We appreciate that as shipping conditions continue to deteriorate these issues are creating a significant strain on our clients. While we are doing our best to ameliorate shortages and price increases as a result of the situation the impact will be felt over the months to come. We will continue to monitor developments and keep in touch with you.

Further sources:

https://en.sse.net.cn/indices/scfinew.jsp

https://theloadstar.com/containership-schedule-reliability-at-lowest-level-since-records-began/

https://www.abc.net.au/news/rural/2021-01-08/high-freight-costs-due-to-covid-impact-tasmanian-agriculture/13035798

https://gcaptain.com/freight-cost-pain-intensifies-as-pandemic-rocks-ocean-shipping/

https://www.spglobal.com/platts/en/market-insights/latest-news/shipping/020921-feature-container-tightness-slows-indias-q1-sugar-export-pace

Our Partnering Manufacturers