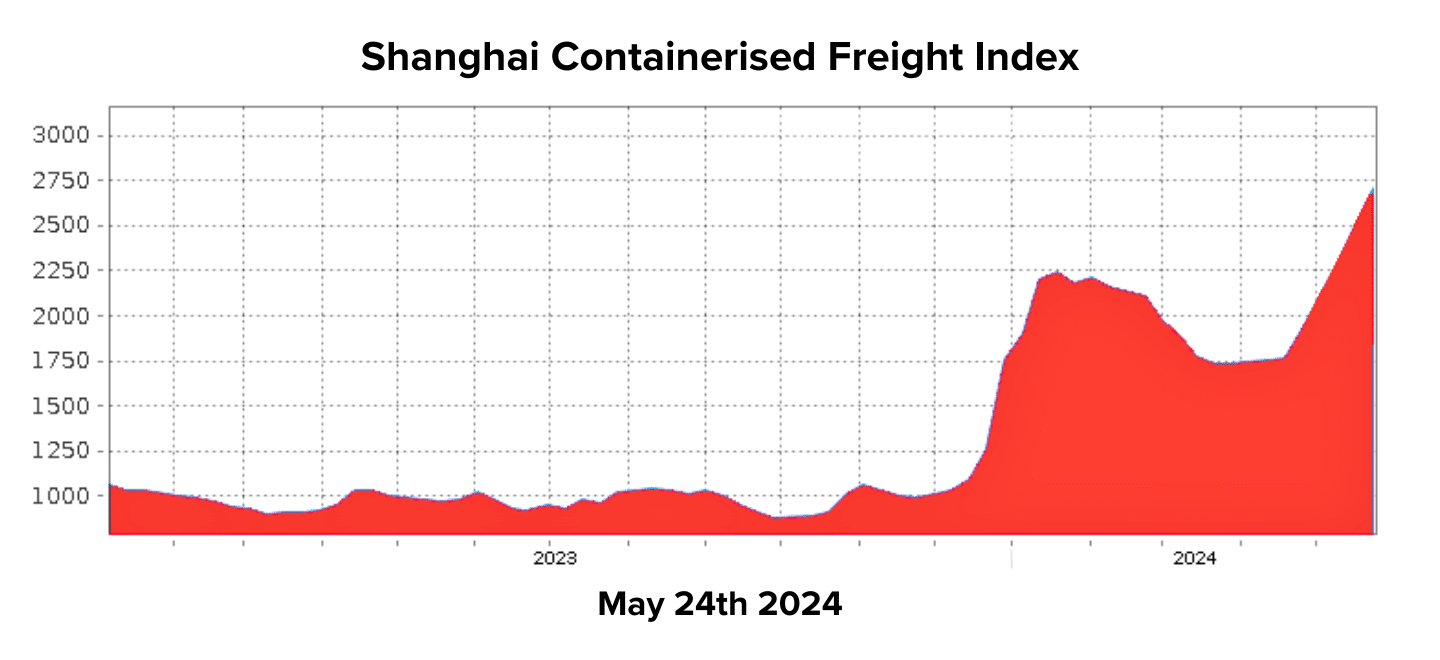

The global shipping industry is grappling with significant disruptions, exacerbated by the Houthi Red Seas attacks and an unprecedented surge in demand. Experts suggest the current situation could prove even more challenging than the COVID-19 pandemic.

One of the major players in the shipping industry, Maersk, has introduced a Peak Season Surcharge, a measure they did not implement during the height of the COVID-19 crisis. The surcharge rates are substantial:

- US$500 per TEU (twenty-foot equivalent unit) from North Asia to Australia,

- US$300 from Southeast Asia to Australia, and

- US$300 from Asia to New Zealand.

The market has seen a jump of over US$1000 per TEU, indicating severe price hikes across the board.

Adding to the strain, Maersk has significantly reduced its allocation from Southeast Asia due to underutilisation earlier this year. While other carriers are temporarily absorbing the excess demand, this presents an ongoing risk to logistics stability.

Transhipment Port Congestion

Transhipment ports, which typically operate smoothly, are now experiencing severe congestion, causing further delays. Cargo that requires transhipment is at high risk of being stuck for extended periods.

Additionally, moving dangerous goods (DG) through certain ports has become increasingly problematic. Recent reports indicate that congestion in Singapore has now surpassed levels seen during the COVID-19 pandemic, compounding the delays.

Equipment Supply Shortages

With more containers spending longer periods at sea, the availability of empty containers at specific ports has sharply decreased. This scarcity of containers is another critical issue with no immediate solution in sight.

Increasing Lead and Shipping Times

Space for shipments from Asia to Australia is currently unavailable until the second week of July, indicating a six-week lead time. The ongoing vessel bunching and transhipment issues suggest that transit times will continue to lengthen in the coming months. While shipments from Southeast Asia to New Zealand are relatively stable for June, the overall outlook remains uncertain.

The Situation in the USA

In the United States, there is growing concern about the return of the US$10,000 container. Shipping rates are increasing by US$1000 per week, with no clear ceiling in sight. The industry is scrambling for solutions:

- Though space is limited, non-dangerous goods rates are available from Xingang and Qingdao to Oakland, Long Beach, Chicago, Newark, and Jacksonville. Suppliers should consider alternative ports and discuss local logistics options with sales representatives.

- Investigating local North American producers and considering road or rail freight across the continent may offer cost-effective alternatives.

For more details on these developments, you can refer to the following articles:

- Maersk Peak Season Surcharge

- Port Congestion Returns to Haunt the Container Markets

- The $10,000 Shipping Container Looms in Latest Trade Strains

The global logistics landscape is facing a critical juncture, and stakeholders must adapt swiftly to navigate these challenges effectively.