Redox Ltd (ASX:RDX, or ‘Redox’ or ‘the Company’), a leading global chemical, ingredients and raw material distributor, announces that it has agreed to acquire 100% of the shares of Oleum Pty Ltd and Oleum Holdings Pty Ltd (‘Oleum’), a specialty and commodity chemicals distributor to the agriculture, mining, personal care and surface coatings sectors.

The acquisition, which is consistent with Redox’s strategy, expands the Company’s customer base in Australia, enhances supplier relationships with globally significant specialty chemical manufacturers and widens the range of products available to Redox’s established clientele. It will allow the Company to better serve the needs of a larger number of clients and help to accelerate growth in key market segments.

Founded in 2015, Oleum is an Australian chemical distributor with a strategic portfolio of surfactants. Oleum sells across a wide range of industries and has a particular focus and strength in Crop Protection and Household/Personal Care. Headquartered in Melbourne, the company consists of a team of 5 who have achieved an outstanding track-record of excellent customer service across a range of compelling offerings from some of the world’s most renowned manufacturers. Sales revenue in 2023 was approximately A$30m.

John Lemanis, Director of Oleum, says:

“Redox is the perfect home for Oleum, the businesses are strategically well aligned and will be highly complementary to each other. My team is excited to join Redox which will leverage what’s great about us with the benefit of Redox’s leading software system, wide logistics network and larger team of salespeople.”

CEO & MD of Redox, Raimond Coneliano, added:

“This is a special opportunity, and we are delighted to welcome John and the Oleum team to Redox. Together our combined knowledge and product portfolio will be an exciting prospect for Australian customers of both companies. In time, we anticipate the opportunity to promote select Oleum products and suppliers to our clients in the United States and around the world. This certainly helps cement Redox as the pre-eminent distributor of chemicals in the region and will provide new avenues for growth.”

Transaction details and transition arrangements

A Share Sale Agreement was executed by the parties on 2nd July 2024, with a simultaneous completion of the transaction. As a result Redox has acquired the key assets of the business as of this date.

Customers and suppliers should continue to deal with Oleum Pty Ltd as per pre-acquisition, it is expected that integration will be completed on the 1st of August 2024 after which all new orders should be placed upon Redox Limited.

Reach out to your Redox or Oleum representative for more details.

– ends –

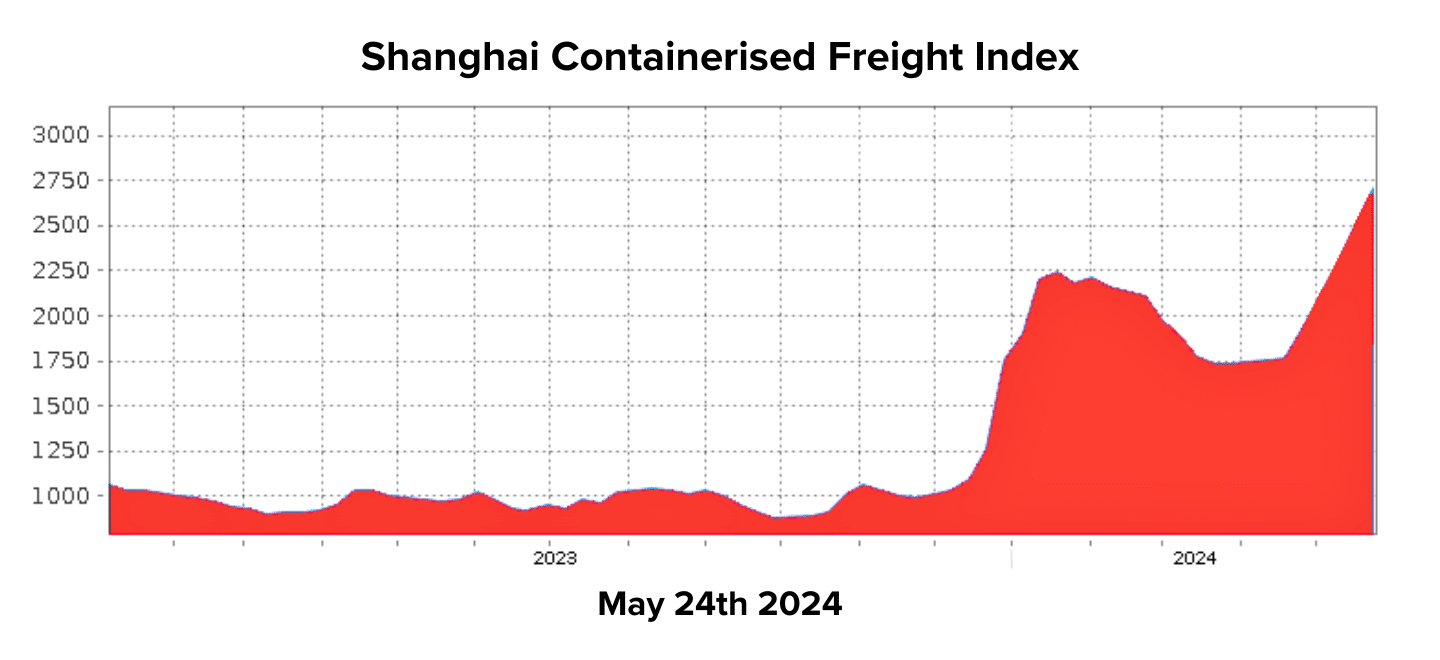

The global shipping industry is grappling with significant disruptions, exacerbated by the Houthi Red Seas attacks and an unprecedented surge in demand. Experts suggest the current situation could prove even more challenging than the COVID-19 pandemic.

One of the major players in the shipping industry, Maersk, has introduced a Peak Season Surcharge, a measure they did not implement during the height of the COVID-19 crisis. The surcharge rates are substantial:

- US$500 per TEU (twenty-foot equivalent unit) from North Asia to Australia,

- US$300 from Southeast Asia to Australia, and

- US$300 from Asia to New Zealand.

The market has seen a jump of over US$1000 per TEU, indicating severe price hikes across the board.

Adding to the strain, Maersk has significantly reduced its allocation from Southeast Asia due to underutilisation earlier this year. While other carriers are temporarily absorbing the excess demand, this presents an ongoing risk to logistics stability.

Transhipment Port Congestion

Transhipment ports, which typically operate smoothly, are now experiencing severe congestion, causing further delays. Cargo that requires transhipment is at high risk of being stuck for extended periods.

Additionally, moving dangerous goods (DG) through certain ports has become increasingly problematic. Recent reports indicate that congestion in Singapore has now surpassed levels seen during the COVID-19 pandemic, compounding the delays.

Equipment Supply Shortages

With more containers spending longer periods at sea, the availability of empty containers at specific ports has sharply decreased. This scarcity of containers is another critical issue with no immediate solution in sight.

Increasing Lead and Shipping Times

Space for shipments from Asia to Australia is currently unavailable until the second week of July, indicating a six-week lead time. The ongoing vessel bunching and transhipment issues suggest that transit times will continue to lengthen in the coming months. While shipments from Southeast Asia to New Zealand are relatively stable for June, the overall outlook remains uncertain.

The Situation in the USA

In the United States, there is growing concern about the return of the US$10,000 container. Shipping rates are increasing by US$1000 per week, with no clear ceiling in sight. The industry is scrambling for solutions:

- Though space is limited, non-dangerous goods rates are available from Xingang and Qingdao to Oakland, Long Beach, Chicago, Newark, and Jacksonville. Suppliers should consider alternative ports and discuss local logistics options with sales representatives.

- Investigating local North American producers and considering road or rail freight across the continent may offer cost-effective alternatives.

For more details on these developments, you can refer to the following articles:

- Maersk Peak Season Surcharge

- Port Congestion Returns to Haunt the Container Markets

- The $10,000 Shipping Container Looms in Latest Trade Strains

The global logistics landscape is facing a critical juncture, and stakeholders must adapt swiftly to navigate these challenges effectively.

Global shipping costs are rising due to Houthi rebel attacks on cargo ships near the Red Sea, impacting the Suez Canal and supply chains in Europe and the U.S. Shipments are delayed, and transportation costs are increasing.

In the week ending January 18, the average cost of shipping a 40-foot container worldwide rose by 23% to $3,777, more than doubling from the previous month, according to a report from London-based Drewry Shipping Consultants.

These issues extend beyond trade routes between China, Europe, and the U.S. Shipping rates from China to Los Angeles increased by 38% in the same week, reaching $3,860.

Philip Damas from Drewry Shipping Consultants notes growing unpredictability in international shipping. While big companies with long-term contracts are somewhat protected, many are paying extra fees, like a 20% surcharge, to cover higher expenses.

In Yemen, Houthi rebels attack commercial ships amid the Israel-Hamas conflict. Despite U.S.-led protection efforts, attacks persist, causing damage to cargo ships.

The International Monetary Fund reports a 37% drop in Suez Canal traffic in 2024 compared to the previous year. Major shipping companies, including A.P. Moller-Maersk and Hapag-Lloyd, reroute ships around Africa, adding over a week to travel times.

The Suez Canal is crucial to reducing international shipping disruptions due to its strategic location, providing a vital and time-saving maritime route that connects the Mediterranean Sea to the Red Sea, allowing ships to bypass the lengthy and perilous trip around the southern tip of Africa.

Amidst the avoidance of the Suez and Red Sea by major shipping lines and the preference for rail transport across Panama, retailers assert their ability to handle delays. Nevertheless, Brian Bourke, SEKO Logistics’ global chief commercial officer, highlights that apparel companies, keen on timely spring fashion arrivals, are resorting to airfreight. Maersk and Hapag Lloyd, significant international containerised shipping lines, have suspended ship movements through the Bab-al Mandab Strait, linking the Red Sea to the Gulf of Aden and the Indian Ocean.

Although primarily impacting Asia to North Europe and Mediterranean routes, historical incidents suggest potential serious consequences in other regions if the situation persists.

Paul Zalai, the Director of Freight & Trade Alliance (FTA) and Secretariat of the Australian Peak Shippers Association (APSA), refers to events from March 2021 when the mega-vessel Ever Given ran aground in the Suez Canal “The impact of the waterway closure for six days threw vessel schedules internationally into disarray – this may fade into insignificance compared to the current conditions that are likely to continue for a significant period with other shipping lines likely to follow, understandably not wanting to endanger the lives of seafarers, the safety of vessels and the cargoes they carry.”

“We are likely to know more in coming days – should marine insurers withdraw policies for ships passing through the area or declare the Red Sea a ”war zone”, shipping lines will be commercially left with little option but to abandon this key waterway,” Zalai said.

Zalai says the withdrawal of vessel services from the route will mean their diversion via the Cape of Good Hope. “This will add about ten days to transit times and estimated arrival dates in North Europe and Mediterranean ports – we can again expect that shipping lines will recover these costs through additional surcharges on cargoes.”

Suez Canal problems compound with challenges at the Panama Canal, limiting ship passage due to a drought.

Party City in New Jersey, facing delays of up to a week and extra charges of $300 to $500 per container from Asia to U.S. ports, strives to ensure timely store deliveries despite setbacks.

Epoxy resins are incredibly versatile and functional, making them essential in various industries. They are used in adhesives, coatings and are critical in many applications. Let’s quickly look into the world of epoxy resins and explore their significant impact on diverse sectors.

Epoxy resins, commonly used in various applications, are typically produced through a chemical reaction between epichlorohydrin (ECH) and bisphenol-A (BPA). This reaction results in speciality resins in either liquid or solid form. The production processes for liquid and solid epoxy resins are similar. Initially, ECH and BPA are combined in a reactor, and a solution containing 20-40% caustic soda is added as the mixture is heated to its boiling point.

After the unreacted ECH evaporates, the resulting mixture is separated into two phases by introducing an inert solvent like Methyl isobutyl ketone (MIBK). Subsequently, the resin is washed with water, and the solvent is removed through vacuum distillation.

Producers incorporate certain additives tailored to the intended application to impart specific properties such as flexibility, viscosity, colour, adhesiveness, and faster curing to the resin.

To transform epoxy resins into a hard, infusible, and rigid material, they must be cured with a hardener. The curing process can occur at a wide range of temperatures, typically between 5 and 150 degrees Celsius, depending on the choice of curing agent. Primary and secondary amines are commonly utilised as curing agents for epoxy resins.

How is it used

Epoxy resins are incredibly versatile and find extensive use across many industries.

- In the adhesive industry, epoxy resins provide exceptional bonding properties, making them indispensable for various applications.

- They also play a crucial role in the coatings industry, where epoxy-based coatings offer superior protection, durability, and corrosion resistance, meeting the stringent requirements of sectors such as automotive, aerospace, and construction.

- In the electronics sector, epoxy resins are employed for encapsulating electronic components, circuit boards, and insulating materials.

- Within the construction field, epoxy resins are utilised for flooring, waterproofing, and concrete repair due to their remarkable strength and chemical resistance.

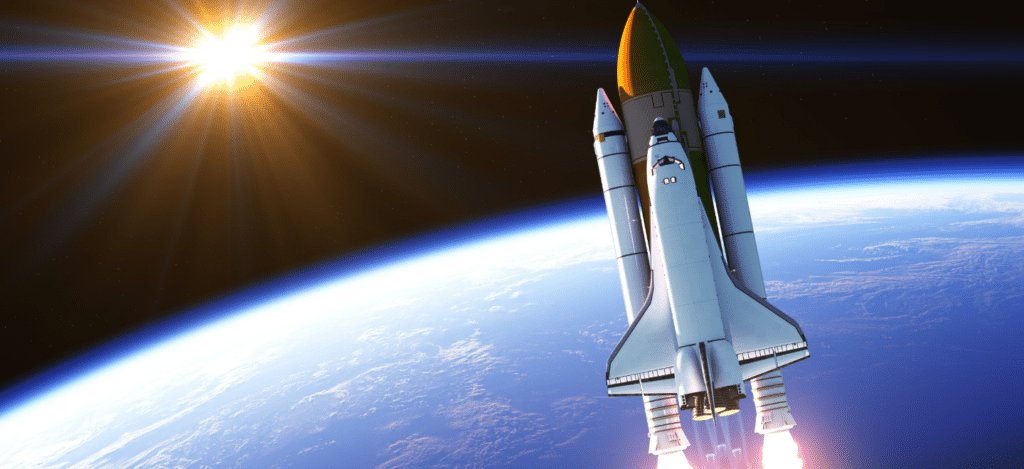

The aerospace industry uses epoxy resin in many innovative ways, including spacecraft hardware fabrication, space suit reinforcement, and improving flame retardancy. This thermosetting polymer’s combined adaptivity and flexibility make it ideal for use in many space travel solutions. They are also used in spacecraft for staking, sealing, coating, encapsulating, potting, and bonding various structural, electronic, and mechanical components.

They also play a vital role in water resistance and structural integrity in the marine industry. At the same time, the automotive and aerospace sectors rely on them for lightweight composites, adhesives, and coatings that enhance performance and safety.

These are just a few examples of how it contribute to various industries, showcasing their versatility and exceptional properties.

How can Redox help

Redox sells and stores epoxy resin products in various countries, including Australia, the United States, New Zealand, and Malaysia.

Discover how Redox can empower your organisation and unlock the full potential of your sourcing capabilities. Contact us now and experience the advantage that Redox brings.

National Science Week is an annual celebration of science and technology in Australia. It happens every year in August and has more than 1000 events around the country, delivered by different types of organisations such as universities, schools, research institutions, libraries, museums and science centres.

The school theme for National Science Week in 2022 will be “Glass: More than meets the eye.” This is to celebrate the United Nations International Year of Glass, Celebrating the past, present and future of glass for a sustainable, equitable and better tomorrow.

In helping to celebrate National Science Week, we thought we could bring our expertise to this year’s school theme – Glass. Redox are very active in this market with a customer base of roughly 154 assorted customers specialising in producing glass products.

Being a leading chemical and ingredients distributor, we supply our customers with various products to help them produce hundreds, if not thousands, of products made of glass.

What are some of the chemicals we supply?

Materials such as:

- Dense Soda Ash,

- Boric acid,

- Borax and,

- Potassium Carbonate,

- Monobutyltin Trichloride,

- Sodium Sulphate.

Are all used in the manufacturing of glass products. But, how are these chemicals used in glass products?

Let’s look a little closer – Monobutyltin Trichloride.

Monobutyltin Trichloride or MBTC’s most critical application area is glass coating. MBTC is used to increase the scratch resistance of glass. A tin oxide coating is applied that closes microcracks and improves resistance to physical effects. It’s an essential raw material for this coating.

In the production of flat glass, for example, it’s combined with other ingredients in a uniform formulation that creates an even and thin layer.

Steve Jobs, the late Apple CEO and innovator known for his innovative genius in technology, sought out Corning’s help to make a screen that would be thin yet durable. Then they came up with Gorilla Glass, which dominates mobile device sales today because it can withstand drops up five feet without breaking or sustaining any damage!

It’s also used to coat containers (bottles, glasses, etc.), where Monobutyltin Trichloride is applied directly via gravity slides, which is depressed into the shape of the final bottle. The still hot bottles then pass through a coating stage where an MBTC vapour is sprayed on the hot surface, which is oxidised. This creates a layer of tin oxide, which forms the coating.

Another critical application the glass industry employs comes from Sodium Sulphate. It’s used as “fining agent” to help remove tiny air bubbles within molten glasses and prevent scum formation during refining. The chemical also fluxes the melts while it prevents melt segregation or caking on equipment by preventing negative interactions between components like acidity levels with base stocks such as silica sand.

Endlessly recyclable and natural

“We’ve been making glass for thousands of years, and we still don’t have a good idea of what it is,” says Mathieu Bauchy, a glass expert and materials researcher at UCLA. One thing we do know, unlike many other materials that become dangerous waste, glass can be recycled and refilled an infinite amount of times without losing clarity, purity or quality.

Have a great National Science Week.

Our Partnering Manufacturers