Molds are filamentous fungi that occur in many feedstuffs including grains and forages. Molds can produce mycotoxins that are formed on crops in the field, during harvest, or during storage, processing, or feeding. The mycotoxins of great concern include aflatoxin (Afla), deoxynivalenol (DON), zearalenone (ZEN), T-2 Toxin (T2), and fumonisin (FUM).

Traditionally, maize was easily contaminated by mycotoxin. However, in a recent survey, 71% wheat samples were contaminated by DON in Australia. Therefore, the routinely use of mycotoxin binders may help ruminant animal to avoid exposure to low levels multiple mycotoxins, considering that these binders could bind mycotoxins strongly enough to prevent mycotoxin absorption across the digestive tract.

Maize has long been known for its susceptibility to mycotoxin contamination. Surprisingly, a recent Australian survey found that 71% of wheat samples were contaminated with deoxynivalenol (DON).

Potential binders include activated carbon, bentonite, zeolite, diatomaceous, earth, cellulose, yeast cell wall polysaccharides, and synthetic polymers such as cholestyramine and polyvinylpyrrolidone.

Activated Carbone: it is a general adsorptive material with a large surface area and excellent adsorptive capacity. It is routinely recommended for various digestive toxicities at 30-50 g per day per cow. previously, it was suggested that Activated Carbone may not be as effective in binding Afla as bentonite or zeolite. However, in a recent in vito trial, it shows an overall better adsorption capacity except for T2 with the lower adsorption capacity.

Bentonite: it is a hydrated sodium calcium aluminum magnesium silicate hydroxide and usually is used as anti-cake agent at 1 to 2% of cattle diets. Based on the recent in vitro trial, it only shows higher adsorption capacity for Afla.

Zeolite: adding 250 to 500 g zeolite per day per cow has been approved to prevent ‘milk fever’. In a recent in vito trial, it also shows a similar adsorption capacity for Afla, T2, and Zen.

Diatomaceous earth: it is usually used as an insecticide on stored cereals and storage rooms. 1% to 2% feed grade diatomaceous earth has also been recommended to add to cattle feed to reduce internal and external worm or parasites. Diatomaceous earth has also shown the potential in vitro to bind Afla.

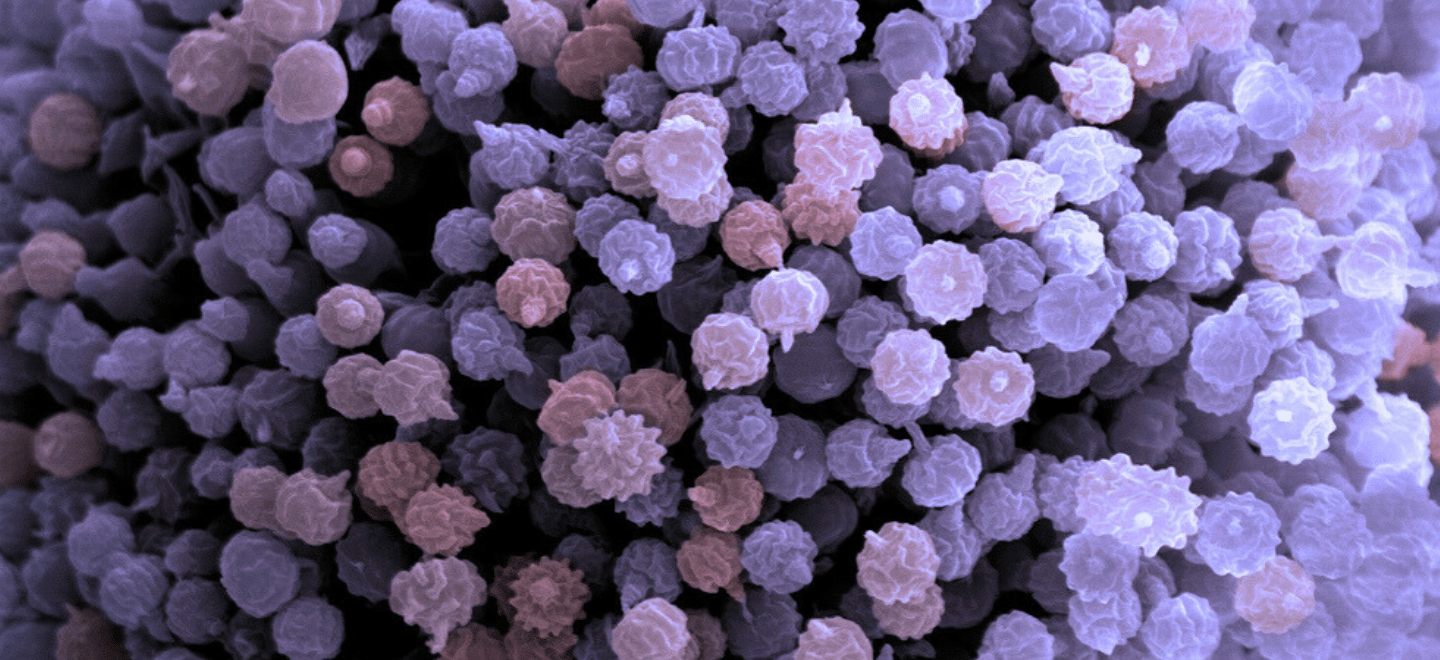

Yeast cell wall polysaccharides: the outer layer of the cell wall constituted with glucomannan and mannon proteins that determine the superficial properties of the yeast cell wall. The adsorption capacity increases as the proportion of β-D glucans present in the yeast strains increases. However, in a recent in vitro trial, the yeast cell wall product for this trial showed the much lower adsorption capacity compared with the activated carbon.

In general, these mycotoxin binds are helpful to reduce the biavailability of mycotoxin. However, it is difficult to select the appropriate adsorbent for each mycotoxin.

A study compiled by our Redox Animal Nutritionists.

Yeast supplements include live yeast, yeast cell wall (YCW), purified outer layer of cell wall components such as mannooligosaccharide (MOS) and β-glucans, purified inner layer of cell wall, and yeast extract products. It is generally accepted that yeast products can improve pig gut health via improved gut integrity and maintenance of a healthy microbiome, leading to increased nutrition absorption, and thus improved overall pig performance.

Live yeast refers to yeast cells that are still alive and active. It is often used to improve digestion and promote gut health for ruminant animals.

After autolysis (using the yeast’s own enzymes) or hydrolysis (using added exogenous enzymes), the yeast extract and cell walls are separated using centrifugation before being dried. Usually, the yeast extract via autolysis contains higher levels of yeast nucleotides. However, the yeast extract via hydrolysis is more applicable due to a low salt concentration.

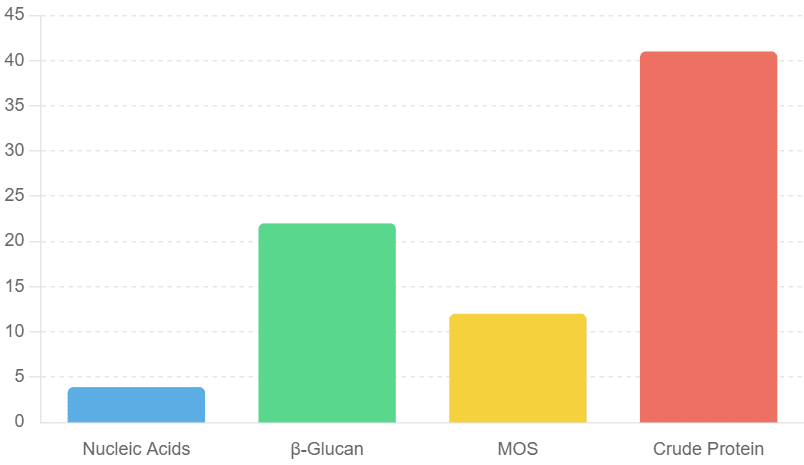

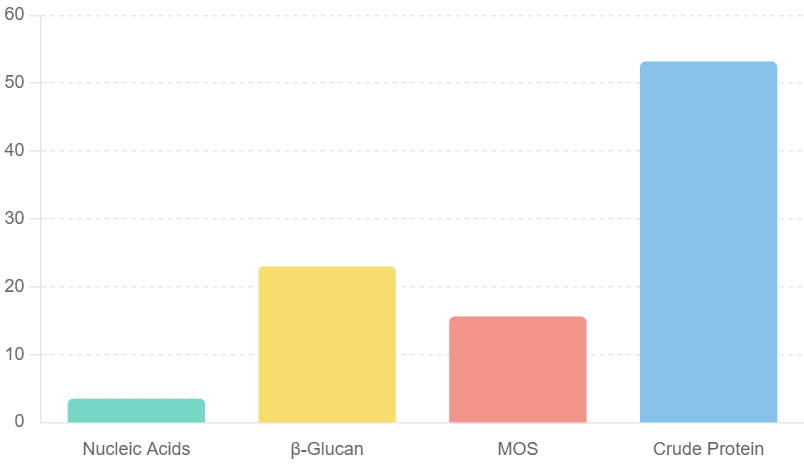

The composition of autolyzed yeast (AY)

The composition of autolyzed yeast (AY) has been summarized as 3.5-3.9% nucleic acids, 11-22% of β-glucan, 3-12% MOS, and 30-41% crude protein. Adding 0.2-0.5% AY to pig diets could improve the performance and immune function of weaned and finished pigs.

The composition of hydrolysed yeast (HY)

The composition of hydrolysed yeast (HY) includes 3.5% nucleic acids, 22.43-23% β-glucan, 15-15.6% MOS, and 40-53.2% crude protein. The effective inclusion rates of HY in diets for the weaned, grower, and finisher periods are 0.1-0.2%, 0.05-1.0%, and 0.1%, respectively.

The yeast cell wall fraction is mainly composed of polysaccharides, making up 15 to 30% of the dry weight of the whole cell. The inner layer of the cell wall mainly contains β-D-glucans which is used as the organic mycotoxin binder. Supplemental levels of the mycotoxin binder are recommended around 0.1 to 0.2%

The outer layer of the yeast cell wall is made of MOS and β-glucans. Adding purified β-glucan to early weaned piglets dets showed protective effects against E Coli infection by reducing bacterial excretion and diarrhoea. The recommended dosage of β-glucan is 100-200 ppm or 100 -200 g/MT feed. The purified MOS can attach the bacterial surface, and then protect the colonization of bacteria in the intestinal tract. Supplementation of MOS in the range of 500 to 1000 ppm or 500 g to 1 kg /MT feed.

In addition, approximately 1-20% of total nitrogen in yeast are derived from nucleic acids. Nucleotides are significantly required by cell replication process, particularly intestinal epithelial and lymphoid cells. Nucleotides are also important in immune system maintenance and prevent oxidative stress. The purified Nucleotide inosine monophosphate (IMP) is commercially available and recommended supplemental levels are ranged 500 ppm to 1000 ppm or 500 to 1000 g/Kg feed.

A study compiled by our Redox Animal Nutritionists.

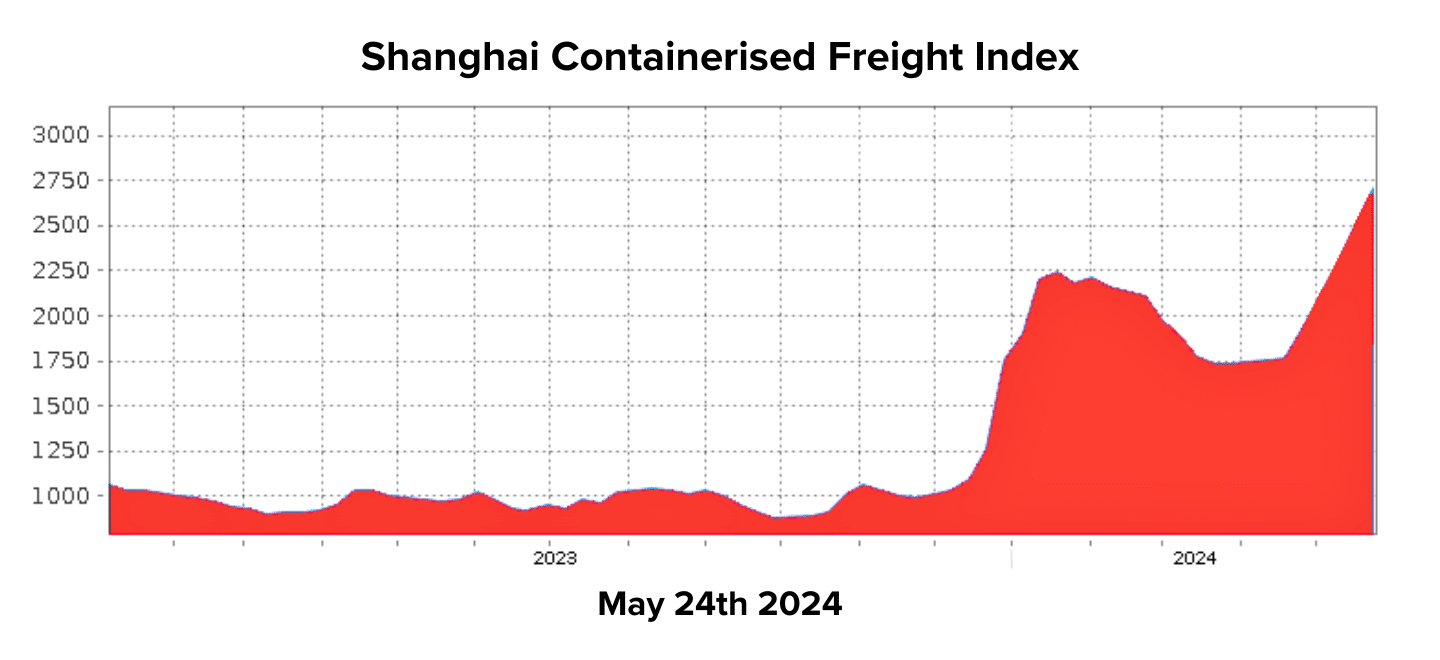

The global shipping industry is grappling with significant disruptions, exacerbated by the Houthi Red Seas attacks and an unprecedented surge in demand. Experts suggest the current situation could prove even more challenging than the COVID-19 pandemic.

One of the major players in the shipping industry, Maersk, has introduced a Peak Season Surcharge, a measure they did not implement during the height of the COVID-19 crisis. The surcharge rates are substantial:

- US$500 per TEU (twenty-foot equivalent unit) from North Asia to Australia,

- US$300 from Southeast Asia to Australia, and

- US$300 from Asia to New Zealand.

The market has seen a jump of over US$1000 per TEU, indicating severe price hikes across the board.

Adding to the strain, Maersk has significantly reduced its allocation from Southeast Asia due to underutilisation earlier this year. While other carriers are temporarily absorbing the excess demand, this presents an ongoing risk to logistics stability.

Transhipment Port Congestion

Transhipment ports, which typically operate smoothly, are now experiencing severe congestion, causing further delays. Cargo that requires transhipment is at high risk of being stuck for extended periods.

Additionally, moving dangerous goods (DG) through certain ports has become increasingly problematic. Recent reports indicate that congestion in Singapore has now surpassed levels seen during the COVID-19 pandemic, compounding the delays.

Equipment Supply Shortages

With more containers spending longer periods at sea, the availability of empty containers at specific ports has sharply decreased. This scarcity of containers is another critical issue with no immediate solution in sight.

Increasing Lead and Shipping Times

Space for shipments from Asia to Australia is currently unavailable until the second week of July, indicating a six-week lead time. The ongoing vessel bunching and transhipment issues suggest that transit times will continue to lengthen in the coming months. While shipments from Southeast Asia to New Zealand are relatively stable for June, the overall outlook remains uncertain.

The Situation in the USA

In the United States, there is growing concern about the return of the US$10,000 container. Shipping rates are increasing by US$1000 per week, with no clear ceiling in sight. The industry is scrambling for solutions:

- Though space is limited, non-dangerous goods rates are available from Xingang and Qingdao to Oakland, Long Beach, Chicago, Newark, and Jacksonville. Suppliers should consider alternative ports and discuss local logistics options with sales representatives.

- Investigating local North American producers and considering road or rail freight across the continent may offer cost-effective alternatives.

For more details on these developments, you can refer to the following articles:

- Maersk Peak Season Surcharge

- Port Congestion Returns to Haunt the Container Markets

- The $10,000 Shipping Container Looms in Latest Trade Strains

The global logistics landscape is facing a critical juncture, and stakeholders must adapt swiftly to navigate these challenges effectively.

Yucca schidigera is an herbaceous plant of lily family, native to the deserts of the southwestern United State and northern Mexico. It contains two active compounds: at least 10.5% steroidal saponins and polyphenols. Saponins are similarly in structure to Glucocorticoids in animals.

Previously It was thought that the Yucca extract could bind ammonia and therefore reduce its emission from pets and other animals. However, ammonia concentrations in the gut are at least 100-fold greater than the concentrations of the yucca extract. Currently it is believed that the high circulating levels of Glucocorticoid in response to various oxidative stress including heat stress result in enhanced degradation of amino acids to generate ammonia and reduced protein synthesis in skeleton muscle.

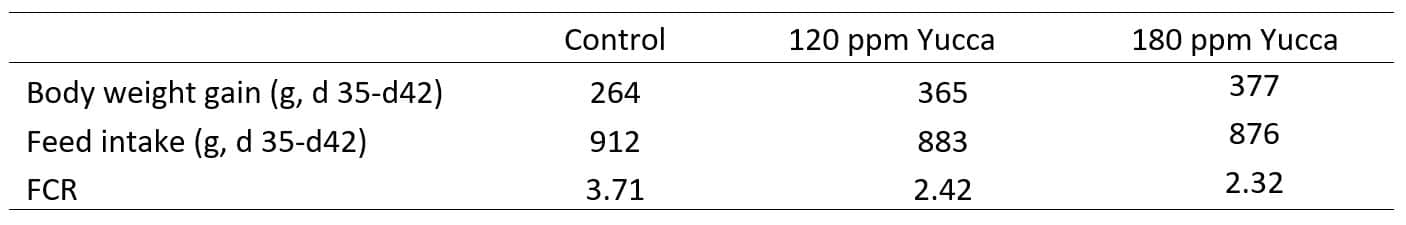

Under conditions of the oxidative stress including heat stress, the Yucca extract can block the bonding of glucocorticoids to their receptors in cells. Thus, the yucca extract could alleviate the oxidative stress including heat stress and reduce ammonium emission in the stress situation (Table 1). When broiler chickens were housed at an average ambient temperature of 24˚C, dietary supplementation of Yucca extract (120 ppm and 180 ppm) did not affect the feed intake or body weight gain (Wu, 2018). However, in table 1, when the ambient temperature was naturally elevated from 27˚C to 37˚C, the Yucca supplementation improved body weight gain by 38-43% and FCR 46% to 52% compared with the control group.

Table 1 The effect of the addition of the Yucca extract on broiler chicken performance under the heat stress

Yucca saponins also have anti-protozoal activity by supressing protozoal infection of the intestine. It is reported that Yucca saponins could bind with cholesterol in protozoal cell membrane and destroy the integrity of the protozoal membrane. Coccidiosis is one of the main challenges for the worldwide poultry industry. Although coccidiostats are often rotated, the poultry industry is challenged by resistance of the Eimeria parasites to these treatments. In a recent trial conducted in the Europe, Kozlowski et al (2022) reported that both the anticoccidial and 500 g/Mt Yucca supplementation showed significant improvement in body weight (2150 g and 2058 g vs. 1998 g, Table 2)

It is now also reported that Yucca polyphenolics have anti-inflammatory activity and could prevent arthritis. The generation of reactive oxygen species such as nitric oxide is an important factor in the development of rheumatic arthritis. Yucca polyphenolics may inhibit nitric oxide production and prevent arthritis.

Table 2. The effect of supplemental Yucca extract on challenged chicken performance (d1-35)

A study compiled by our Redox Animal Nutritionists.

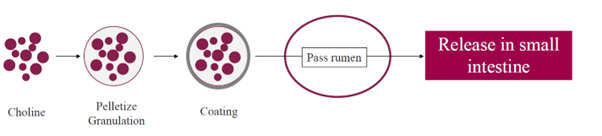

Rumen protective choline (RPC) is a double coated form of choline designed to withstand the microbial degradation in the rumen. RPC product feature is shown in Figure 1. Supplementation of RPC in dairy cattle has been shown some positive effects on milk production and cow health.

Figure 1. RPC production feature

RPC supports the liver’s function, particularly during the critical transition period, helping cows to use energy more efficiently and prevent fatty liver syndrome. It also plays a role in the transport of nutrients across cell membranes, in the blood stream and mammary gland. Recent studies in USA indicated that addition of RPC in the transition period could increase 2 kg milk production per day per cow.

Interestingly this effect could carry over the entire 40 weeks (280 days) of lactation period. Possibly the better health in the transition period by adding RPC extended the life span of the mammary cells or reduced the rate of cell death in the mammary gland.

Previously it was thought that RPC was a nutrient that would be fed only to fat, over conditioned cows. It is now believed that supplementing RPC to a low body condition score cow also increases milk and colostrum production.

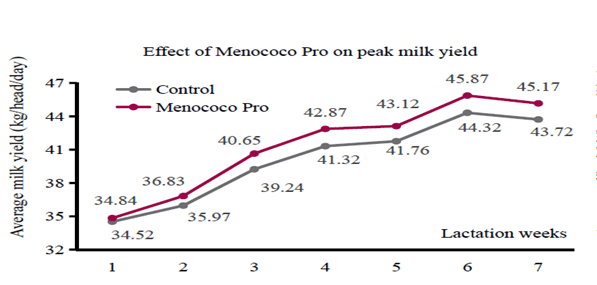

Commercially, two experiments were conducted in China. In trial 1, during 21 days before calving to 21 days post calving period, 50 grams of Meno-Pro (RPC) were fed to 25 dairy cows per day per cow. Another 25 dairy cows were not supplemented with RPC as the control group. The milk production in 7 weeks of lactation period is shown in Figure 2. Within 7 weeks, adding RPC increased total milk yield by 1482 kg for 25 dairy cows. Average milk yield increased by 1.21 kg per day per cow.

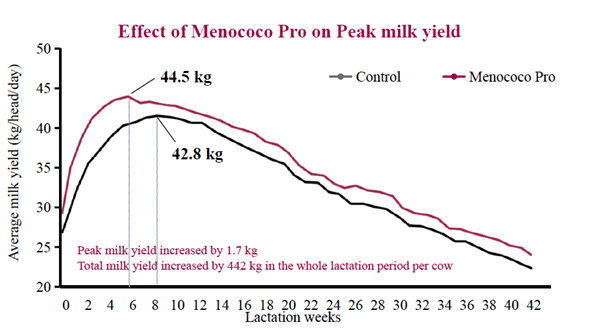

In trial 2, during 21 days before calving to 21 days post calving period, 50 grams of Meno-pro (RPC) were fed to 50 dairy cows per day per cow. Another 50 cows were not supplemented with RPC as the control group. The milk yield in 42 weeks of lactation period is shown in Figure 3. Averagely, the addition of RPC only in the transition period could increase total milk yield 442 kg per cow.

Figure 2. Effect of RPC on milk production in 7 weeks of lactation period

Figure 3. Effect of RPC on milk production in entire lactation (42 weeks) period

A study compiled by our Redox Animal Nutritionists.

It is well known that in the current floor pen with deep litter system, day old broiler chickens could benefit from non-starch polysaccharides components in the litter to establish the dynamic microbiota. However, when the intestinal microbiota becomes complex and diversified over time and environmental conditions, long term exposure to faeces and ammonia pollution environments has a higher risk of infection with pathogenic bacteria and parasites.

For decades, chicken enteric disease including necrotic enteritis (NE) and coccidiosis have been controlled by using antibiotic growth promoters (AGP) and coccidiostats. However, due to the development of antibiotic resistance in bacteria and coccidiosis, which is a threat to animal and human health, the use of AGP and coccidiostats has been restricted or banned in the poultry industry. Thus, alternatives production strategies including vaccinations, organic acids, prebiotics, probiotics, essential oils, postbiotics or yeast peptides to control NE and coccidiosis have been explored.

The Glucose Oxidase (GOD) is exogenously produced by specific fungi fermentation to oxidize β-D-Glucose into gluconic acid and hydrogen peroxide, consuming large amounts of oxygen at the same time in the chicken gut. Therefore, it can protect against oxidative stress and directly kill some pathogenic bacteria or Eimeria parasites. Gluconic acid is a kind of organic acid, which acts as an acidifier in the intestine to produce the short chain fatty acids such as butyric acid. GOD also plays an important role in colour development, flavour, texture, and increasing the shelf life of food products. Due to its characteristics of producing natural acid, deoxygenation and sterilization, GOD has been defined in AAFCO list as 70.3 and widely used in animal production.

Recently, the University of New England (UNE) conducted a NE challenging trial to investigate the GOD potentials to ameliorate the impact of NE on chicken performance and intestinal health. The standard, positive controls (PC) were formulated based on wheat-sorghum-soybean meal as the commercial diets. Negative control (NC) chickens were challenged with Eimeria parasites at day 9 and clostridium perfringens at day 14. Another 4 treatments consist of PC or NC diets supplemented with antibiotics, GOD 100 g/MT, 200 g/MT and 300 g/MT, respectively.

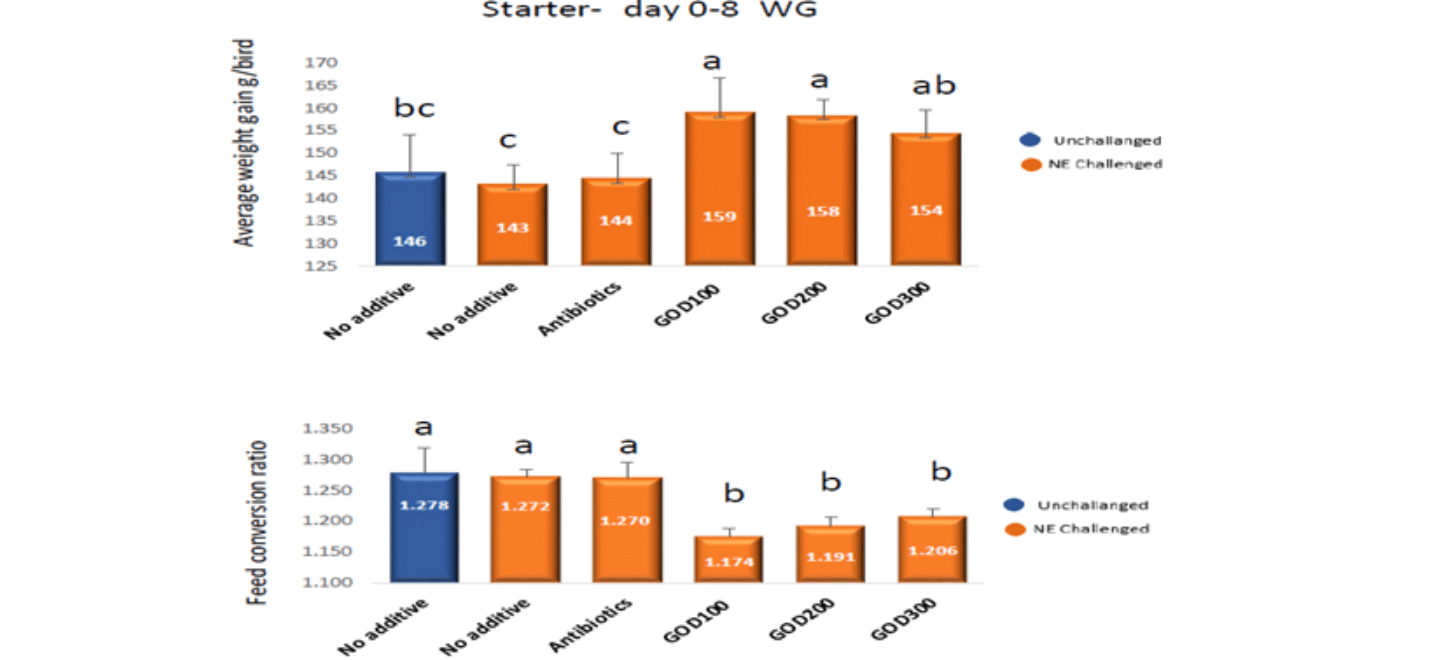

The effect of GOD on chicken performance before challenging was shown in Figure 1. It is clearly shown that adding GOD significantly improved chicken body weight gain by 9% and FCR was improved by 10 points. From the growth point of view, AGP supplementation did not show any impact on chicken body weight gain and FCR.

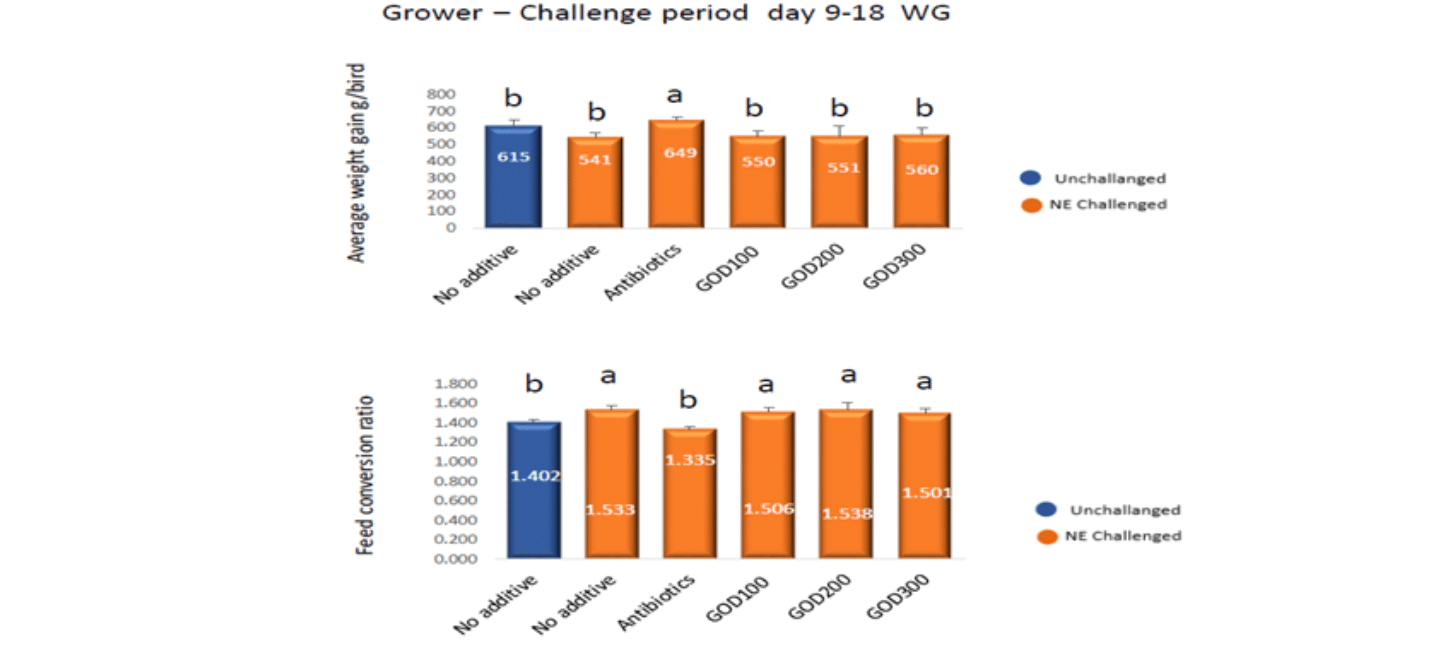

However, during the challenging period (Figure 2), AGP significantly improved the chicken body weight gain and FCR compared with the positive control. Interestingly, during the recovery period (Figure 3) or chickens had the longer-term exposure to faeces and ammonia pollution, chickens in positive control and supplemented with the lowest GOD showed worst performance, but chickens in the negative control showed the best performance, possibly due to that Eimeria challenged birds boomed their immune system for the possible coccidiosis infection. It might also imply that supplementation of GOD could replace both coccidiostat AGP.

However, the lower level of GOD might have the negative effect of Eimeria vaccination.

Figure 1. The effect of GOD on chicken performance before challenging.

Figure 2. The effect of GOD on chicken performance during challenging.

Figure 3. Efeect of GOD on chicken body weight gain after challenging period (d 28-35)

A study compiled by our Redox Animal Nutritionists.

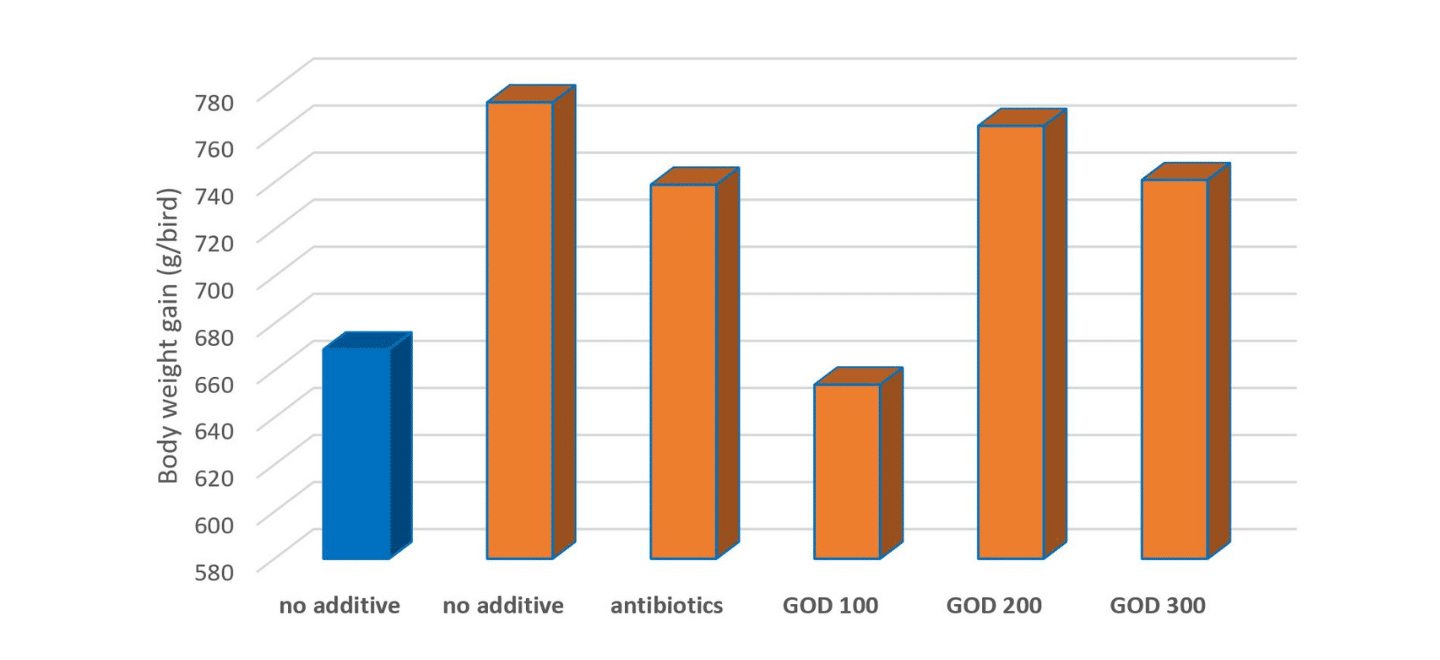

Rumen microorganisms can utilize non-protein nitrogen (NPN) such as ammonia to synthesis rumen microbial proteins for cattle and sheep. Urea is a cheap source of NPN but the hydrolysis rate of urea in the rumen is speedy and exceeds the ammonia utilisation rate of rumen microorganism. Surplus ammonia is harmful to the animal and is also associated with increased methane production. Coated urea is designed to provide a controlled release of urea in the rumen, allowing for a more efficient utilisation of nitrogen by rumen microbes.

In Figure 1, it is clearly shown that compared with Menogen plus (the coated urea), normal urea is almost completely degraded within 20 minutes. On the other hand, the degradation rate of soybean meal or canola meal is too slow. Within 8 hours, the degradation rate of soybean meal and canola meal is about 50% and 30%, respectively, considered as the good source of rumen undegraded protein.

However, less ammonia concentration may not provide sufficient nitrogen source for rumen microorganisms to effectively synthesise rumen microbial protein. Therefore, addition of the coated urea could provide stable nitrogen supply for rumen microbes. It is reported that providing 90 grams coated urea per day per cow could replace 450 grams soybean meal and increase milk production by 0.85 kg per day per cow.

Figure 1. The degradation rate of different nitrogen sources in Rumen

In summary, this controlled release urea can lead to several benefits in terms of methane reduction and overall animal nutrition:

- Reduced ammonia levels:

The coated urea undergoes gradual hydrolysis in the rumen, releasing ammonia at a controlled rate. This controlled ammonia release ensures a stable nitrogen supply for rumen microbes, reducing excess levels. High ammonia levels in the rumen are associated with increased methane production.

- Improved microbial protein synthesis:

The coated urea supports the growth of rumen microbes by providing a steady and controlled supply of ammonia. These microbes are responsible for breaking down fibrous materials and producing microbial protein. Efficient microbial protein synthesis can lead to improved feed digestion and reduce d methane emissions.

- Optimised nitrogen utilisation:

The coated urea allows for better synchronisation between available nitrogen and microbial needs. This synchronisation can lead to improved utilisation of dietary protein and reduced excretion of nitrogen in the form of urea. Lower nitrogen excretion can contribute to reduced ammonia levels and subsequently, reduced methane production.

- Balanced rumen environment:

The coated urea helps in maintaining a stable rumen PH and stable pH conditions are conductive to the growth of specific microbes that produce less methane during feed digestion.

- Increased fibre digestibility:

Improved microbial efficiency and balanced rumen pH can enhance the digestion of fibrous materials. Enhanced fibre digestion results in fewer substrates available for methane-producing microbes, leading to reduced methane emission.

A study compiled by our Redox Animal Nutritionists.

The beginning of 2024 has raised concerns about a potential crisis in the International Shipping industry, reminiscent of the challenges faced during the COVID-19 pandemic. Various factors, including instability in the Red Sea, a drought affecting the Panama Canal, and industrial action at DP World, impact both containerised freight’s cost and reliability. In the last week of 2023, shipping rates surged by an unprecedented 40% within a single week, indicating significant disruptions. [1]

Geo-political issues, war & Houthi rebel attacks in the Red Sea have caused an undeniable shock to the global supply chain. Major Containerised shipping lines are now avoiding transiting the Suez Canal and instead diverting around the cape of Good Hope – adding three weeks to their transit times. With 30%[2] of Global container trade passing through the Suez, this has had significant flow on effects to all areas of shipping. Prices have been reported to have surged up to five-fold on European routes and doubled or tripled on other non-European routes. [3]

Red Sea at Aqaba in Jordan – International Shipping impacted by geo-political tensions in the Red Sea. Shipping lines diverting around Cape of Good Hope.

The Panama Canal is facing a severe drought, reducing its operational capacity. As a result, daily traffic has decreased by nearly 40% [5] compared to the previous year, with restrictions allowing only 24 vessels per day instead of the usual 36[4]. This reduction in capacity is impacting shipping lines, either causing them to divert around South America or resort to rail transport across Panama. Customers on the East Coast of America are particularly affected, experiencing increased prices and extended transit times.

Although the Asia to Oceania trade might not be directly affected by issues in the Red Sea and Panama Canal individually, combined, these areas traditionally handle a significant portion of containerised freight movements. Rerouting vessels around Africa alone reduces global containerised shipping capacity by 9% [6], leading to vessels being reallocated from Oceania and other regions. This imbalance results in price hikes and difficulties in accessing empty containers.

While Industrial action at DP World ceased at the beginning of February, the flow of effects will continue to be felt for the coming weeks and months. With a backlog of over 50,000 containers across most Australian ports and vessels out of rotation, delays can continue to be expected until this backlog is cleared. Whether related or not, the deal was reached on the same day as DP World announced prices increases of 52%[7], which will be passed on to the importer.

The hope for stability in the International Shipping Market post the Lunar New Year Holidays is tempered by continued increased transit times due to diversions around the Suez and Panama Canal. This ongoing situation will lead to sustained price and scheduling pressures. Planning ahead, allowing additional lead time, and considering increasing order sizes are advisable. Customers are encouraged to consult with their Redox representatives to devise strategies for minimising risks and addressing any shipping challenges that may arise.

Layer chickens’ dietary fibre comprises a significant part of plant feedstuffs and is chemically defined as the non-starch polysaccharides (NSP). The NSP include various fibre types such as lignin, β-glucans, arabinoxylans, uranic acid, galactose, and mannose.

Soluble NSP such as arabinoxylans in wheat or mannans in soybean meal will increase the chicken gut viscosity, resulting in detrimental effect on chicken performance and egg production. Therefore, adding xylanase and β-mannnase blend to layer chicken wheat-soy based diets could remove these anti-national factors and reduce the energy cost of immune responses.

Recently, White et al (2021) reported that adding β-mannnanase to the corn-soy based diets for laying hens significantly increased egg production by 6% (88.55% vs 94.94%). In laying chickens feed formulation, adding β-mannanase could save about 100 Kcal/kg apparent metabolizable energy (AME) and 1%-unit crude protein level.

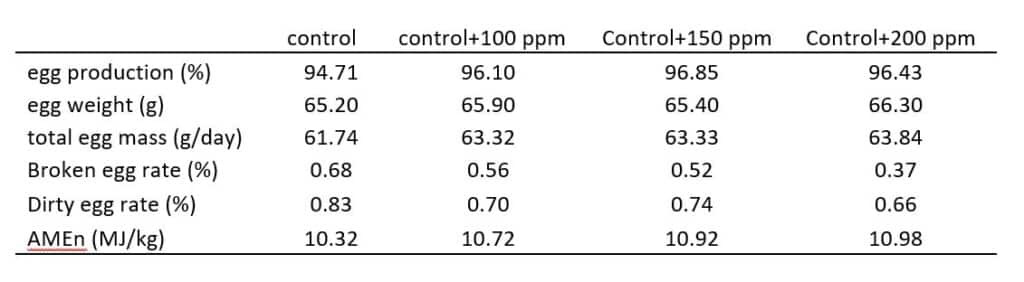

In Germany, VTR conducted a layer chicken trial to investigate the effect of the exogenous xylanase on egg production and apparent N-corrected metabolizable energy (AMEn). On the base of a standard corn-wheat-soybean meal diets, 100, 150, and 200 grams/Mt xylanase were added to include a total of 4 treatments. The effect of xylanase on egg production and egg quality was listed in Table 1. It is clearly shown that adding 200 g/MT xylanase increased egg production by 1.8% and significantly reduced dirty and broken eggs. It cam also increase about 150 kcal AMEn.

Table 1. The effect of Xylanase on egg production and egg quality (week 25 to week 32)

On the other hand, the insoluble NSP such as lignocellulos have a positive effect on animal health and productivity. In particular, for free rage layer chickens, feather pecking, and cannibalism are a serious problem and the increased insoluble NSP or fibre has been widely shown to reduce feather pecking and cannibalistic behaviours. This effect is generally attributed to increased time spent eating, thus reducing redirected behaviours. JELUVET®lignucellulose contains 67.7% crude fibre, mainly comprising of cellulose and hemicellulos (62%). Therefore, it is a good source of insoluble NSP to reduce feather pecking for free range layer chickens.

A study compiled by our Redox Animal Nutritionists.

In the often-overlooked realm of soil lies a bustling ecosystem teeming with microorganisms, where a mere teaspoon of soil houses more life than the entire human population on Earth. This intricate world is vital in maintaining soil fertility, influencing nutrient cycling, enhancing plant growth, and even breaking down toxic substances.

Microbial Abundance and Importance:

Delving into the microscopic universe, we find staggering numbers: a kilogram of fertile soil can host 500 billion bacteria, 10 billion actinomycetes, and 1 billion fungi. These microorganisms play a crucial role in soil fertility by cycling nutrients, improving structure, and supporting plant health. They also act as nature’s recyclers, breaking down toxic substances through enzymatic activities.

Factors Influencing Microbial Presence:

Various factors, such as temperature, humidity, oxygen levels, soil pH, nutrient availability, and management practices, influence the presence and activity of microorganisms in the soil. Temperature, in particular, plays a pivotal role in microbial development; at very low temperatures, the enzymatic activity of these organisms is reduced, and protein denaturation may occur at high temperatures.

Humidity and oxygen concentrations also have an important role; in well-aerated soil, there will be greater energy production, a more significant population, and activity of microorganisms. For example, thiobacillus, vital in solubilisation, works more quickly under warm and moist conditions. Low temperatures slow the action of Thiobacillus bacteria.

Microbial Fertilisers and Their Role:

Microbial fertilisers contribute to soil and plant health, comprising bacteria, algae, fungi, and biological compounds. These microbes colonise the rhizosphere upon application, multiplying rapidly and producing trillions of beneficial organisms within a few days. These microbes can act as biological predators, producing antibiotics, enzymes against pathogens, and phytohormone production that benefit plant growth.

Microbial Benefits:

The advantages of soil microorganisms are multifaceted. They help control the spread of diseases through competition, antibiosis, parasitism, and resistance induction. These tiny life forms also play vital roles in nutrient mineralisation, phosphate solubilisation, and controlling soil salinity.

Microorganisms improve a plant’s ability to withstand environmental stresses like water scarcity by employing different mechanisms, such as producing substances that keep the roots hydrated.

Moreover, microorganisms aid in bioremediation, mitigating phytotoxicity and heavy metal contamination by metabolising these substances into inert forms. They enhance plant tolerance to abiotic stresses, such as water stress, through various mechanisms, including producing substances that hydrate roots.

Mycorrhizae – Nature’s Symbiotic Partners:

A significant player in the soil ecosystem is mycorrhizae, a mutualistic symbiosis between soil fungi and plant roots found in over 80% of vascular plants. This partnership enhances nutrient and water transfer, improves soil structure, and boosts plant vigour. Mycorrhizae secrete enzymes that break down nutrients, making them accessible to plants.

Biological Solutions for Sustainable Agriculture:

Highlighting the potential of microbial products, such as Redox Bactivate 3-5 Liquid and Reox Bactivate Biocult, we witness how specific strains of bacteria contribute to better and healthier soil and enhance overall crop quality. These products demonstrate benefits like improved nutrient uptake, soil-bound nutrient solubilisation, and enhanced environmental stress resistance.

How can we help?

In the intricate dance of soil microorganisms and mycorrhizae, we discover a symphony of life that sustains the very foundation of our agricultural ecosystems. By understanding and harnessing the power of these microscopic wonders, we pave the way for sustainable and resilient agriculture, ensuring the health of our soils and the prosperity of future generations.

Contact us today to explore how our microorganism solutions can contribute to your plant’s success. Your plants deserve the best; we’re here to help you achieve just that.

Article compiled by our Redox Agronomists

Our Partnering Manufacturers