The beginning of 2024 has raised concerns about a potential crisis in the International Shipping industry, reminiscent of the challenges faced during the COVID-19 pandemic. Various factors, including instability in the Red Sea, a drought affecting the Panama Canal, and industrial action at DP World, impact both containerised freight’s cost and reliability. In the last week of 2023, shipping rates surged by an unprecedented 40% within a single week, indicating significant disruptions. [1]

Geo-political issues, war & Houthi rebel attacks in the Red Sea have caused an undeniable shock to the global supply chain. Major Containerised shipping lines are now avoiding transiting the Suez Canal and instead diverting around the cape of Good Hope – adding three weeks to their transit times. With 30%[2] of Global container trade passing through the Suez, this has had significant flow on effects to all areas of shipping. Prices have been reported to have surged up to five-fold on European routes and doubled or tripled on other non-European routes. [3]

Red Sea at Aqaba in Jordan – International Shipping impacted by geo-political tensions in the Red Sea. Shipping lines diverting around Cape of Good Hope.

The Panama Canal is facing a severe drought, reducing its operational capacity. As a result, daily traffic has decreased by nearly 40% [5] compared to the previous year, with restrictions allowing only 24 vessels per day instead of the usual 36[4]. This reduction in capacity is impacting shipping lines, either causing them to divert around South America or resort to rail transport across Panama. Customers on the East Coast of America are particularly affected, experiencing increased prices and extended transit times.

Although the Asia to Oceania trade might not be directly affected by issues in the Red Sea and Panama Canal individually, combined, these areas traditionally handle a significant portion of containerised freight movements. Rerouting vessels around Africa alone reduces global containerised shipping capacity by 9% [6], leading to vessels being reallocated from Oceania and other regions. This imbalance results in price hikes and difficulties in accessing empty containers.

While Industrial action at DP World ceased at the beginning of February, the flow of effects will continue to be felt for the coming weeks and months. With a backlog of over 50,000 containers across most Australian ports and vessels out of rotation, delays can continue to be expected until this backlog is cleared. Whether related or not, the deal was reached on the same day as DP World announced prices increases of 52%[7], which will be passed on to the importer.

The hope for stability in the International Shipping Market post the Lunar New Year Holidays is tempered by continued increased transit times due to diversions around the Suez and Panama Canal. This ongoing situation will lead to sustained price and scheduling pressures. Planning ahead, allowing additional lead time, and considering increasing order sizes are advisable. Customers are encouraged to consult with their Redox representatives to devise strategies for minimising risks and addressing any shipping challenges that may arise.

Global shipping costs are rising due to Houthi rebel attacks on cargo ships near the Red Sea, impacting the Suez Canal and supply chains in Europe and the U.S. Shipments are delayed, and transportation costs are increasing.

In the week ending January 18, the average cost of shipping a 40-foot container worldwide rose by 23% to $3,777, more than doubling from the previous month, according to a report from London-based Drewry Shipping Consultants.

These issues extend beyond trade routes between China, Europe, and the U.S. Shipping rates from China to Los Angeles increased by 38% in the same week, reaching $3,860.

Philip Damas from Drewry Shipping Consultants notes growing unpredictability in international shipping. While big companies with long-term contracts are somewhat protected, many are paying extra fees, like a 20% surcharge, to cover higher expenses.

In Yemen, Houthi rebels attack commercial ships amid the Israel-Hamas conflict. Despite U.S.-led protection efforts, attacks persist, causing damage to cargo ships.

The International Monetary Fund reports a 37% drop in Suez Canal traffic in 2024 compared to the previous year. Major shipping companies, including A.P. Moller-Maersk and Hapag-Lloyd, reroute ships around Africa, adding over a week to travel times.

The Suez Canal is crucial to reducing international shipping disruptions due to its strategic location, providing a vital and time-saving maritime route that connects the Mediterranean Sea to the Red Sea, allowing ships to bypass the lengthy and perilous trip around the southern tip of Africa.

Amidst the avoidance of the Suez and Red Sea by major shipping lines and the preference for rail transport across Panama, retailers assert their ability to handle delays. Nevertheless, Brian Bourke, SEKO Logistics’ global chief commercial officer, highlights that apparel companies, keen on timely spring fashion arrivals, are resorting to airfreight. Maersk and Hapag Lloyd, significant international containerised shipping lines, have suspended ship movements through the Bab-al Mandab Strait, linking the Red Sea to the Gulf of Aden and the Indian Ocean.

Although primarily impacting Asia to North Europe and Mediterranean routes, historical incidents suggest potential serious consequences in other regions if the situation persists.

Paul Zalai, the Director of Freight & Trade Alliance (FTA) and Secretariat of the Australian Peak Shippers Association (APSA), refers to events from March 2021 when the mega-vessel Ever Given ran aground in the Suez Canal “The impact of the waterway closure for six days threw vessel schedules internationally into disarray – this may fade into insignificance compared to the current conditions that are likely to continue for a significant period with other shipping lines likely to follow, understandably not wanting to endanger the lives of seafarers, the safety of vessels and the cargoes they carry.”

“We are likely to know more in coming days – should marine insurers withdraw policies for ships passing through the area or declare the Red Sea a ”war zone”, shipping lines will be commercially left with little option but to abandon this key waterway,” Zalai said.

Zalai says the withdrawal of vessel services from the route will mean their diversion via the Cape of Good Hope. “This will add about ten days to transit times and estimated arrival dates in North Europe and Mediterranean ports – we can again expect that shipping lines will recover these costs through additional surcharges on cargoes.”

Suez Canal problems compound with challenges at the Panama Canal, limiting ship passage due to a drought.

Party City in New Jersey, facing delays of up to a week and extra charges of $300 to $500 per container from Asia to U.S. ports, strives to ensure timely store deliveries despite setbacks.

Our warehouses will be closed for an essential Stocktake on Thursday, June 29th and Friday, June 30th.

Consequently, the final deliveries before the closure will occur on Wednesday, June 28th.

Normal operations will resume on Saturday, July 1st ready to serve you with our usual efficiency and reliability.

Please ensure you plan your orders accordingly, considering this temporary interruption in our operations. We understand the significance of maintaining a seamless supply chain for your business needs, and we appreciate your understanding and cooperation during this period.

Should you have any questions or require further assistance, please do not hesitate to contact our customer support team, who will gladly assist you.

The shipping market has been under immense pressure over the past year. We have seen shipping prices skyrocket and ships facing considerable delays for various reasons, most notably the pandemic. However, there is some good news on the horizon.

Shipping prices have stabilised, and shipping times have begun to improve. However, some significant uncertainties could still impact shipping in the coming months as we head into the traditional peak season for shipping. The biggest concerns are labour disputes at West Coast American ports and continued apprehension regarding COVID-19 policy within China.

Shipping during the peak season can be difficult for raw material providers as demand can grow 11-15%. The increased demand for consumer goods around the holiday season globally creates shipping issues for all, including those moving raw materials. This is because shipping lines do not prioritise raw materials over consumer goods.

Several ongoing labour disputes are affecting major ports globally, with dealers particularly prevalent on the West Coast of the USA and in some European countries. These disputes typically result in increased dwell time and can reduce the global capacity for large container vessels. One of the main issues causing concern is the looming expiration of port workers’ contracts on the West Coast of the USA in June. Data shows congestion is already starting to build up in Californian ports, with containers waiting for more than nine days on average – the highest figures seen year to date.

Port of Long Beach: The pandemic has put immense pressure on the shipping network, but dockworkers have continued to rise to the challenge. Their hard work has kept the US economy moving, even in difficult times.

In Europe, there is also an ongoing threat of trade action slowing down major feeder ports in the United Kingdom and Germany, which would have flow-on effects across the continent. While it is difficult to predict the outcome of these disputes, it is clear that they are having a significant impact on global trade.

The appearance of the Omicron strain in China led to a 70-day lockdown of Shanghai, which resulted in delays for 20% of the world’s container ships. This had a significant impact on the ability of suppliers to manufacturing goods globally. Another lockdown could occur in any city, province or port, which would further delays and disruptions. The continued zero COVID-19 policy in China is an ongoing, difficult to predictable variable in global shipping.

Despite the challenges of 2020, the shipping industry has shown its resilience in the face of disruption. And while the worst of the COVID-19-induced supply disruptions may be over, it is crucial to be prepared for continued uncertainty ahead. The good news is that carriers are already planning for the 2022 shipping peak season and are implementing measures to avoid a repeat of last year’s disruption.

It is essential to discuss strategies to mitigate shipping issues with your sales representative and book stock well ahead of time to minimise risk. Doing so can help ensure that your materials arrive promptly and without incident.

Redox has reaffirmed our commitment to the health, safety, and security of our employees, community, and the environment, by successfully passing NACD’s Responsible Distribution® verification for the current three-year cycle.

Responsible Distribution is the National Association of Chemical Distributor’s (NACD) third-party-verified environmental, health, safety, and security program. It allows members to demonstrate their pledge to continuous performance improvement in chemical storage, handling, transportation, and disposal.

In December 1991, the member companies of NACD undertook as its most important mission the inception of Responsible Distribution, developed by NACD members for NACD members.

Responsible Distribution is a mandatory third-party verified environmental, health, safety & security program that lets members demonstrate their commitment to continuous performance improvement in every phase of chemical storage, handling, transportation, and disposal.

NACD members play a leadership role in their communities as information resources. They are eager to provide the same assistance and guidance to local, state, and federal legislators on technical issues relating to the safe handling, storage, transportation, use, and disposal of chemical products.

Key Benefits of Responsible Distribution

- Lower occurrences of safety and environmental incidents

- Enjoy better documentation of company policies

- Employ practices of excellence and quality systems throughout your operations

- Engage in better communication with local communities

- Reduce audit costs and time spent on audits

- Save on insurance expenses

- Improve marketplace visibility and earn credibility through performance

“Responsible Distribution is critical to the chemical distribution industry’s ability to safely deliver more than 30 million tons of product every year,” said NACD President and CEO Eric R. Byer.

“Through their successful verification, Redox and its senior leadership have committed to continuous improvement in the responsible management and handling of chemicals that ensures NACD members effectively support the industries America relies on most, such as agriculture, healthcare, oil and gas, manufacturing equipment, and many others.”

Please click here to view NACD Responsible Distribution’s Guiding Principles.

COVID-19 in China, increased pricing and international tensions continue to significantly impact the global container shipping industry. While spot shipping prices have reduced 10% this year, recent increases in fuel prices will continue to pressure pricing and reliability.

There has been a significant flare-up in COVID-19 cases across China since our last shipping bulletin. Currently, the Shanghai region is under stay at home orders, which has begun to affect port operation directly. It has reduced labour availability, closed factories and limited vehicle ability to deliver containers to the Ports.

Congestion off southern China ports is now at record highs with an inability to efficiently operate all vessels. However, this congestion could ease in the short term, and pricing could be further reduced due to factories not having an adequate output.

As a result, there will be no immediate demand for shipping. However, the pent up demand could cause a whiplash effect in the coming weeks and months to push pricing back to record highs.

Busy Yangshan container port, Shanghai, China is but one of the ports affected by the resurgence of COVID-19 in China

These effects are not just limited to Shanghai and Southern China, with reports of increasing cases in regions dotted all over China. Freightos reported that this current wave of COVID-19 throughout China could

“make this iteration the most significant logistics disruption since the start of the pandemic”.

The Russian-Ukrainian conflict has impacted both the demand and price of bunker fuel. The crisis has meant that freight historically transiting from Asia to Europe by rail will now travel by ship, pushing up global demand for charter vessels, invariably impacting all international pricing.

However, the more significant impact could be on the supplier of bunker, with increases of up to US$100 per tonne a day recorded. Pricing has increased by a third since the end of February, adding millions of dollars to the cost of operating a vessel. These costs will invariably be passed on to the shipper in the way of an increased bunker surcharge.

While Redox’ acknowledges that there has been a short term reduction in pricing, there are still significant unknowns within the global supply chain. Please liaise with your Redox representative to discuss the best way to reduce risk & cost in your business throughout 2022.

Global shipping delays and ongoing disruption in the shipping industry will continue to affect global imports and exports throughout 2022. Prices will likely continue to rise, reliability remains at record lows, and congestion shows no sign of easing.

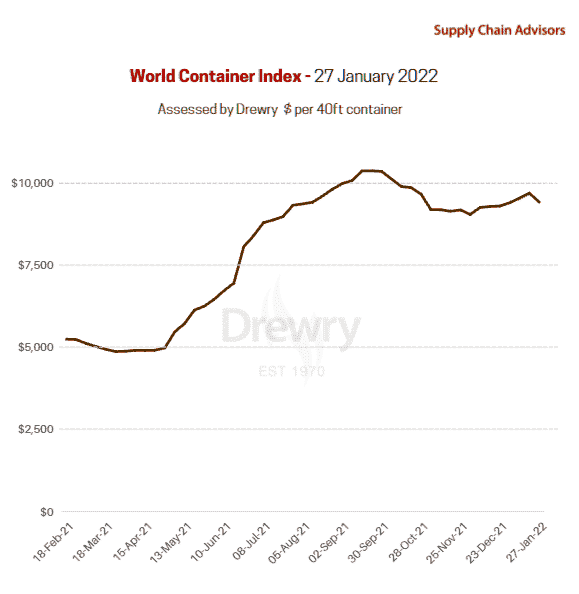

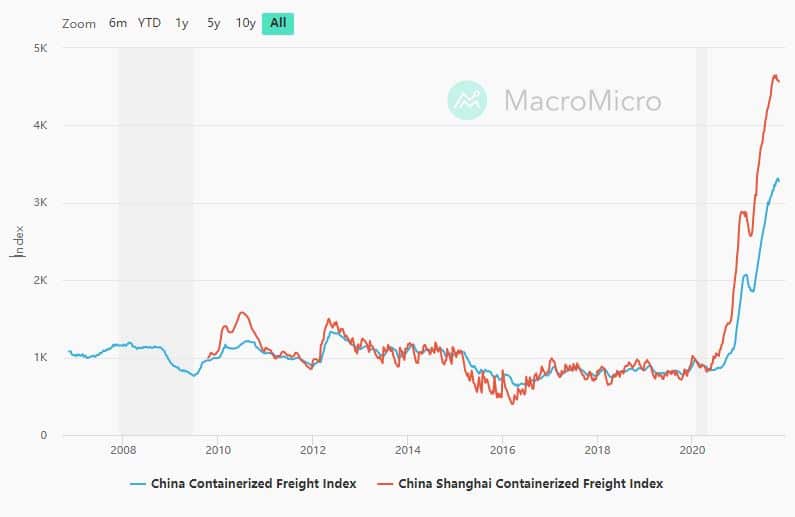

Since our last update, the Shanghai containerised Freight index has increased by 10%, and while the Drewery Index has not shown such a sharp increase in the preceding three months, it has increased by 79% over the past 12 months. This equates to freight prices being up to 10 times higher than pre-pandemic levels.

Unfortunately, these continual price escalations can double or triple the cost of goods Redox imports. Global indications are that the prices will not reduce significantly in the short term and will likely never return to pre-pandemic levels.

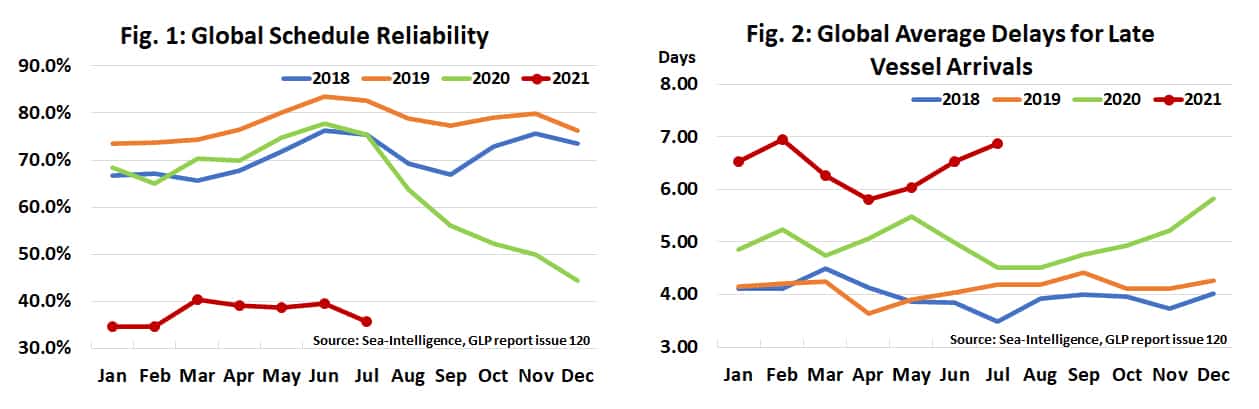

Shipping reliability has hit a record low of 32% in December, suggesting only 3 in 10 container vessels arrive at their destination on time. Each delayed vessel arrives 7.33 days late, causing further congestion across all major ports. Vessels were reported waiting off Long Beach/Los Angeles ports for an average of 17.9 days. This not just cause delays to each shipment but reduces capacity and increases shipping costs globally.

One of the most significant impacts on the Global Shipping Industry for 2022 will be China’s Covid policy. If they continue to take a Zero Tolerance approach, how that will affect our imports. Already in 2022, Ningbo Port has been shut down, and there have been many other scares or delays for very small outbreaks. With China home to 7 of the world’s top 10 ports, any closures will have an impact globally, on top of the evident effect of not being able to get goods from that region throughout the closure.

Locally, there have been delays in collecting containers from the ports and additional “Covid Levies” being arbitrarily charged by stevedores and transport companies alike. Sydney and Melbourne Ports have reported delays of up to 9 days due to reduced staffing to discharged ships and load trucks. As a result of this, many companies have added a new Covid Levy. For example, ACFS stevedoring will charge an additional $25 & Qube transport $28.50 per container, adding $53.50 to each import.

While costs continue to increase and reliability continues to dwindle, Redox is doing its utmost to maintain the best pricing and service for our customers. Please continue to stay in contact with your Redox Representative to discuss a range of strategies to reduce risk to your supply chain and to further understand how pricing and reliability will affect your business moving forward.

Since our last update, there have been significant international and domestic events which have impacted shipping. China’s energy rationing has reduced the demand for outbound freight while, domestically, the Industrial action between Patrick’s and the Maritime Union of Australia has increased delays at Australian wharves.

Over the last month, 20 of China’s 31 Provinces have implemented strict power restrictions, which will result in a reduction in manufacturing and exports. The Shanghai containerised Freight Index reflects this, having, in essence, remained steady for all of October, fluctuating between 4614 at the start of October to 4583 now (see fig. 1.0).

Unfortunately, this paints a better picture than what can be predicted. Any disruptions or significant change to the supply chain will likely increase bottlenecks, change schedules, and finally, increase delays to supply and raised costs. Maersk, the worlds largest Container Line, stated, “This may harm supply chains”.

Fig.1.0 CCFI is based on the freight rate and volume of 12 routes around the world, reflecting changes in freight rate. Departing ports include ports of Dalian, Tianjin, Qingdao, Shanghai, Nanjing, Ningbo, Xiamen, Fuzhou, Shenzhen and Guangzhou.

Locally, the ongoing industrial action between Patricks Terminals and the Maritime Union of Australia (MUA) has further escalated with Patrick’s attempting to have the Enterprise Agreement terminated. MUA have retaliated with further industrial action, adding to the over 220 Industrial activities undertaken since negotiations.

These developments will further increase delays to vessel schedules, which have already had ships in Sydney wait up to eighteen days to berth, nine days in Melbourne, eight in Brisbane and three in Fremantle —in turn, reducing the total amount of shipping containers able to reach the Australian market.

Aerial view of the Port Botany in Sydney, one of the affected ports facing increase delays to vessel schedules.

As a direct example, the MUA has refused to unmoor a vessel for 48 hours. The ship does a specific rotation between Singapore and Fremantle that 48 hours waiting if happened consistently would reduce capacity on this lane by 15%.

While industrial action continues at Australian ports, further delays and vessels being forced to skip planned ports will, unfortunately, continue.

Overall, Redox predicts ongoing changes to the supply chain over the coming 12 months. While there is ever instability and disruption, prices will not reduce, and reliability will not improve.

Please continue to stay in close contact with your Redox Representative to discuss a range of strategies to reduce risk to your supply chain and to further understand how pricing and reliability will affect your business during the coming 18 months.

This past month has seen continued container delays, pricing and reliability pressures on the container shipping industry. The issues have become well publicised across most media outlets as information becomes more available.

Containerised freight prices have reported various levels of increases, the Drewry composite World Container index has risen for 17 straight weeks and now sits at $US9421.48 per 40-foot container, a 358% higher than the same week in August 2020.

For our customers, we suggest that you be aware of these increases and understand that this can significantly affect the cost of goods we sell. There is no suggestion that prices will ease in 2022 so please do not wait longer than normal in the hope of freight price reductions. Further to this for longer term supply contracts to ensure we can provide the best service possible discuss options with your sales representative to allow for the ever-changing freight costs.

Global schedule reliability has remained reasonably steady at 35-40% for the most part of 2021, the average vessel delay has also been 6-7 days. Noting that, to get containers from Asia to Australia and New Zealand a container may be on 2-3 vessels turning a 6–7-day delay per vessel, into a potential four week plus delay for each container.

To mitigate this risk for our customers Redox owns and operates, 7 sites with the ability to store in excess of 65,000 pallets. On top of this we have a further 50 sites worldwide in which we can store additional stock. As such we suggest either purchasing product early to ensure it is available when needed or discussing a storage solution with your Redox Representative.

We anticipate that these pressures will be ongoing for at least the next 18 Months and we will continue to assist our customers in understanding this information and how to minimise the on-going impact to your business.

Please continue to stay in close contact with your Redox Representative to discuss a range of strategies to reduce risk to your supply chain and to further understand how pricing and reliability will affect your business during the coming 18 months.

Dear customers and partners, we have been informed by both CHEP/ Loscam and other pallet providers that they will not be able to meet the increased demand for pallets.

As a result there may be some delays in delivery, or you may be contacted by your Redox representative and asked if you could consider taking goods on pallets which might not be your first preference.

You may de-hire returnable pallets with Redox and this will help us through the current difficulties, please make sure they are clean and in good shape.

If you are a client who exchanges pallets on delivery it is very important that you have the pallets available to exchange or the delivery may not be unloaded.

Pallet shortages advised by some pallet providers advise that they will not be able to meet the increased demand for pallets.

Our Partnering Manufacturers